The price of a starter home has exceeded $1 million in over 100 U.S. cities and towns, according to the latest Zillow data. The national average for a starter home has now reached $196,611, a 54.1% increase over the past five years. This rise significantly outpaces the 49.1% increase in overall home prices. Simultaneously, the average cost of all homes has risen to $412,300, up 28% since the second quarter of 2020. This troubling trend, coupled with escalating rents and mortgage rates, underscores a deepening income inequality and growing housing disparities, making homeownership increasingly elusive for many Americans, particularly those from historically marginalized groups.

A Starter Home or a Pipe Dream?

The concept of a starter home traditionally evoked images of modest, affordable properties that provided a foothold for first-time buyers in the housing market. Owning a little house on a plot of land had once become synonymous with the American dream – a sign of prosperity and social mobility.

Builders like entrepreneur Abraham Levitt and his two sons, William and Alfred, mass-produced small homes post-World War II, especially to address the severe housing shortage for returning veterans. These homes, typically 800 to 1,000 square feet with simple interiors, were more affordable and often in need of a little TLC. However, the reality today is starkly different.

According to Zillow, the average price of a starter home has soared by 54.1% over the past five years, outpacing the overall rise in home prices, which stood at 49.1% during the same period. In 1947, starter homes cost $8,000 to $12,000, equivalent to $109,000 to $168,000 today.

In contrast, in more than 100 cities and towns across the U.S., the price tag for a starter home has now crossed the $1 million mark. California, New York, and Washington are leading this trend, with California alone having 71 cities where a starter home is now priced over $1 million. This sharp increase in starter home prices has fundamentally altered the housing market’s accessibility, making the notion of owning a starter home increasingly resemble a pipe dream for young and first-time buyers.

The Impact on Black Families

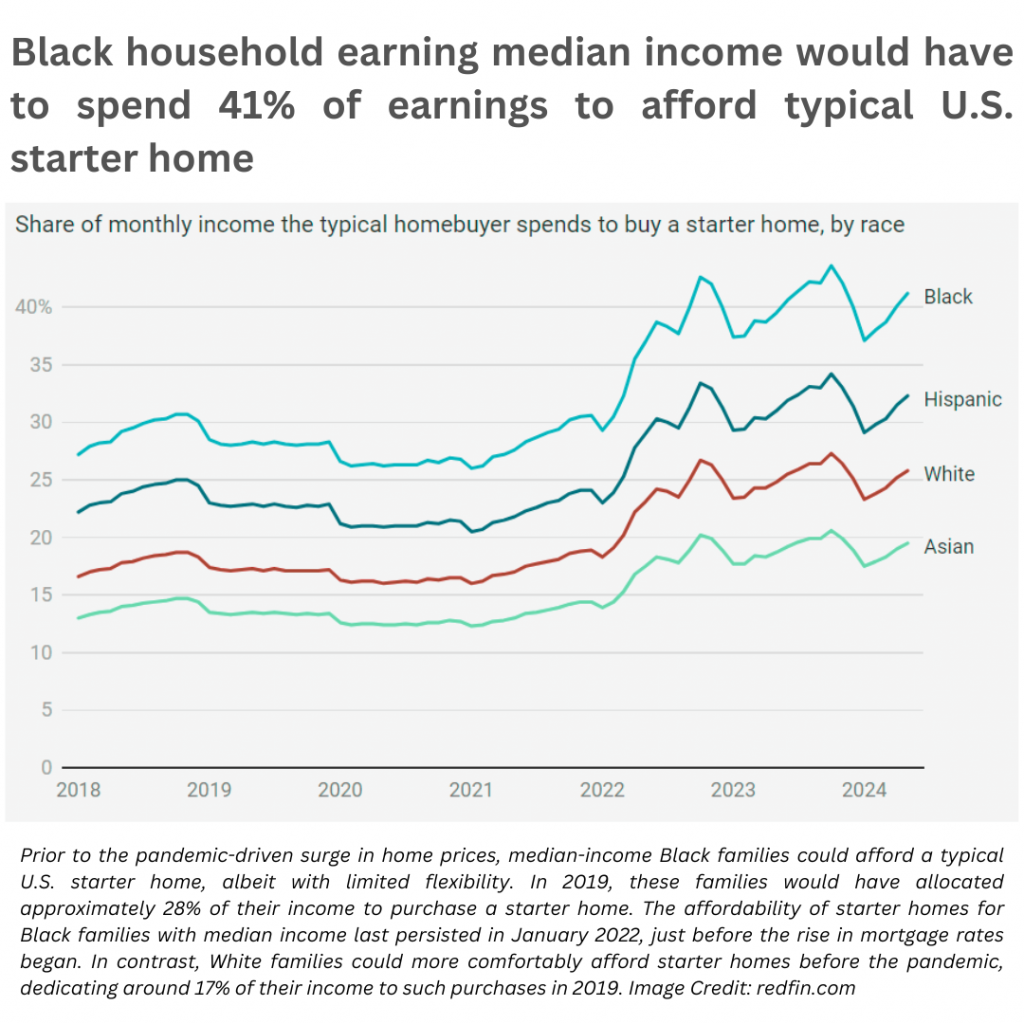

The disparity in homeownership rates between Black and white families is one of the most glaring examples of how these rising home prices are intensifying existing inequalities. A recent study by Redfin highlights that Black families can afford starter homes in only 10 of the 50 largest U.S. metropolitan areas. In stark contrast, white families can afford starter homes in 32 of these areas.

In cities like San Francisco, the situation is even more dire. A Black family earning the local median income would need to allocate 104% of their earnings just to afford a starter home. This is not just unaffordable – it’s impossible. The same study found that nationwide, a Black family earning the median U.S. income would have to spend 41% of their earnings on housing costs for a typical starter home. Meanwhile, a white family would only need to spend 26% of their income for the same property.

These statistics are not just numbers – they represent real people being priced out of the American Dream. The racial wealth gap, combined with a history of discriminatory practices in the housing market, has left Black families particularly vulnerable to these market shifts. This is reflected in the broader homeownership statistics, where the homeownership rate for Black Americans stands at just 44%, compared to 72.7% for white Americans.

The Role of High Mortgage Rates

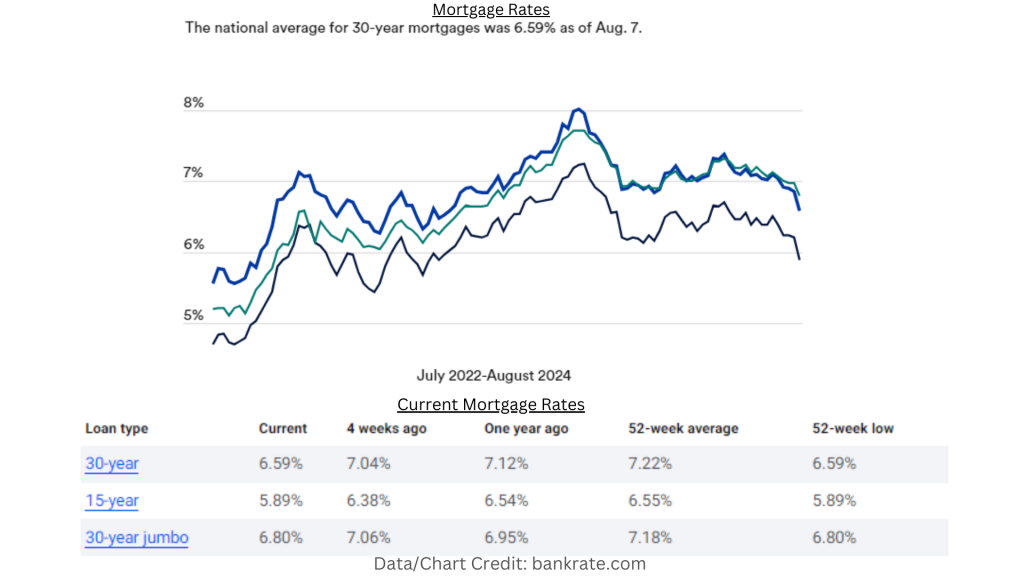

The Federal Reserve’s tight monetary policy, aimed at curbing inflation, has also played a major role in the current housing crisis. Mortgage rates have been hovering at levels not seen in over two decades, making borrowing more expensive and further stretching the budgets of potential homebuyers.

Many buyers are holding off on jumping into the market, hoping to see lower mortgage rates or home prices later this year,” noted Hannah Jones, senior economic research analyst at Realtor.com, as reported by Forbes.

But, while mortgage rates have shown some signs of easing, as presented in the chart above, they remain prohibitively high for many, particularly first-time buyers who are already struggling to save enough for a down payment. According to the U.S. Department of Housing and Urban Development, the national median family income for 2024 stands at $97,800.

The National Association of Realtors (NAR) reported that the median price of an existing home sold in June 2024 reached a record $426,900, and the median age of first-time homebuyers has risen to 35, up from 34 in 2019. This delay in homeownership is largely due to the time it takes for young adults to save for a home, especially in an environment where prices continue to soar and wages are not keeping pace. With a 20 percent down payment and a mortgage rate of 6.59 percent, the resulting monthly payment of $2,179 would represent 27 percent of the typical family’s monthly income.

The Supply and Demand Imbalance

At the heart of this crisis is the chronic shortage of affordable housing. The Covid-19 pandemic added to the already significant deficit in available homes, particularly in high-demand areas like Boston, Sacramento, and Portland, Oregon. Despite a ramp-up in construction over the past few years, the supply of new homes has not been sufficient to meet the growing demand.

Builders have increased their efforts to address this shortage, but the focus has often been on more expensive homes, which offer higher profit margins. As a result, the construction of entry-level homes has lagged significantly. The Census Bureau reported that only 7% of homes built in 2019 were considered entry-level, a sharp decline from the 40% of homes built in 1980 that fell into this category.

Although housing starts increased from under 1.3 million in 2019 to 1.6 million in 2021 and stabilized at 1.4 million in June, the construction industry’s shortage of up to 500,000 workers has posed challenges for even top homebuilders in maintaining quality standards across various regions.

Moreover, many of the areas experiencing the highest home prices have stringent zoning regulations that further restrict new housing development. This combination of high demand and low supply has created a perfect storm that drives prices upward, nearly extinguishing the dream of homeownership for many Americans and widening the gap between the affluent and those less well-off.

Is a Starter Home Worth It?

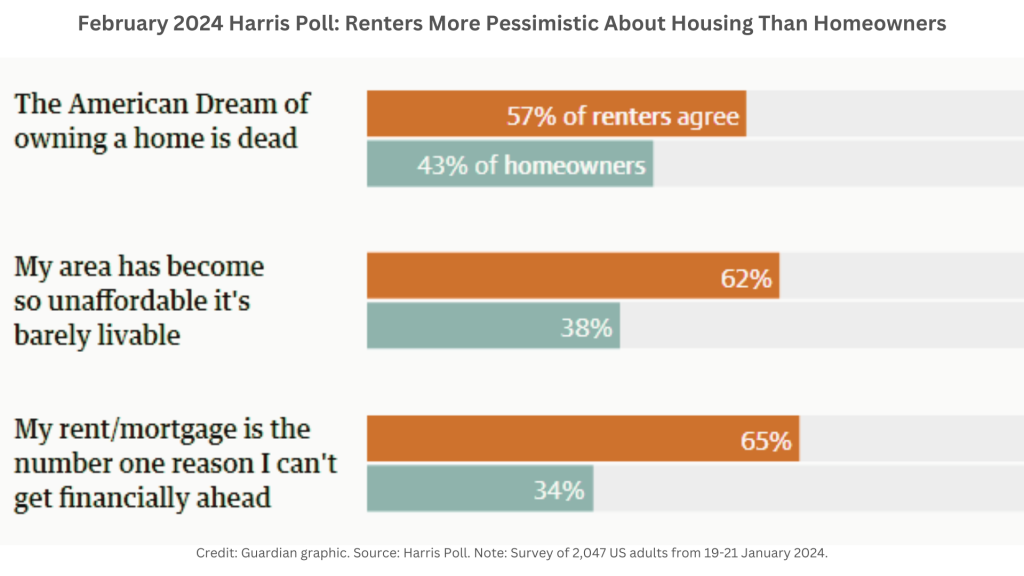

Given these challenges, prospective buyers are questioning whether purchasing a starter home makes sense in today’s market. The latest Bank of America Homebuyer Insights Report, conducted in collaboration with the Bank of America Institute, reveals that 70% of potential homebuyers fear a lack of long-term investment, while 72% worry about rising rents affecting their finances. The benefits of owning a starter home, such as lower monthly payments and quicker equity building, are increasingly overshadowed by fierce competition and the need for substantial repairs or upgrades.

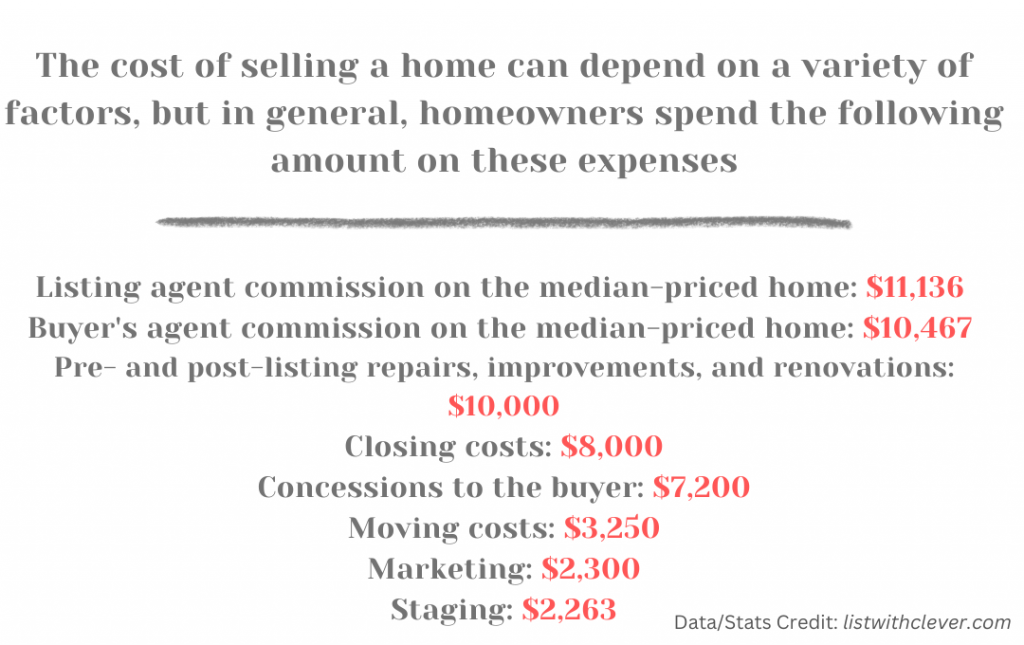

Moreover, the costs associated with buying and selling homes – such as closing costs, moving expenses, and possible renovations – can erode any potential equity gains. A new survey by Clever Real Estate found that Americans spend nearly $55,000 on home-selling expenses. This figure surprised 64% of sellers, leading 89% of recent sellers to regret their sale due to high costs cutting into their profits.

In light of these factors, it may be more cost-effective in many cases to save longer and purchase a larger, permanent home that can accommodate future life changes, rather than moving twice within a short period.

The Wealth Gap and Long-Term Economic Impact

The trend in the housing market toward $1 million starter homes signals deeper issues within the U.S. economic system rather than reflecting a healthy economy. As home prices rise, wealth becomes increasingly concentrated among property owners, and this adds the income inequality.

This wealth gap is further widened by the faster appreciation rates of higher-priced homes. A Zillow analysis from 2021 revealed that while all homes appreciated similarly in percentage terms, higher-priced homes yielded much greater absolute dollar gains. Consequently, homeowners in higher price brackets build wealth more rapidly, entrenching economic disparities.

Moreover, the deepening affordability crisis is likely to lead to more pronounced regional divides, with high-income areas becoming increasingly inaccessible to middle- and lower-income families. This trend could result in significant economic segregation within cities or regions, affecting social mobility and economic diversity.

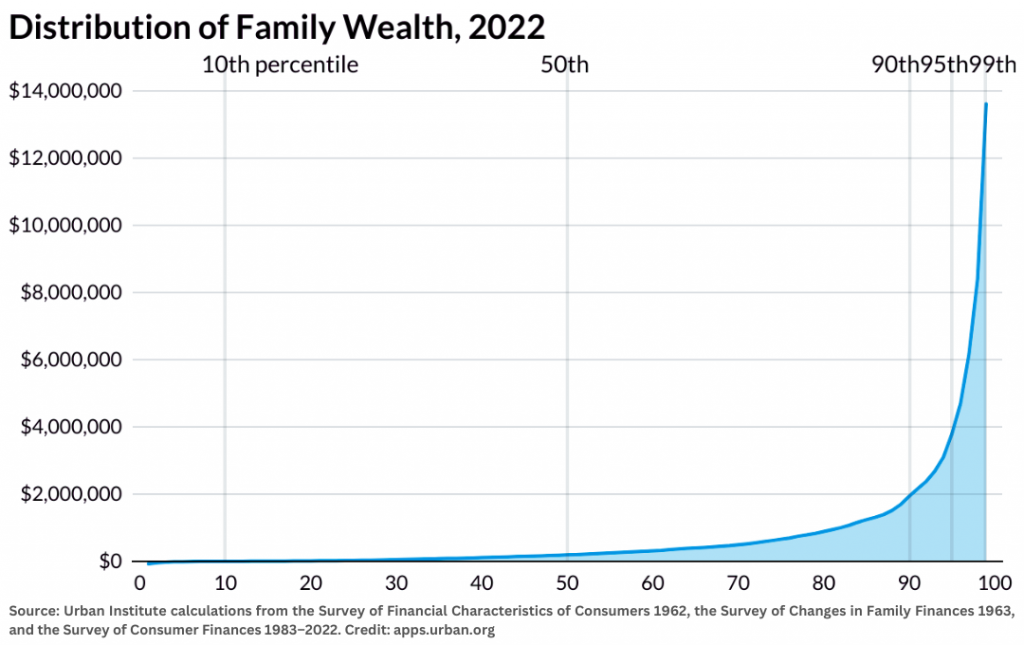

Between 1963 and 2022, wealth distribution shifted notably: the 10th percentile’s wealth grew from $23 in debt to $450, the 50th percentile’s wealth nearly quadrupled, the 90th percentile’s wealth increased more than sixfold, and the top 1% saw a sevenfold rise. From 2016 to 2022, the wealth gap narrowed, with the wealth of the top 1% decreasing from 107 times to 71 times that of the median family.

The Future of the Housing Market

Looking ahead, the housing market is set to encounter a defining moment. The Federal Reserve is expected to cut interest rates to 5.1% by the end of 2024, while the CME Group’s FedWatch tool forecasts the first cut in September, which could offer some relief for mortgage affordability. However, any significant reduction in rates could also lead to a renewed surge in home prices, as more buyers flood the market in search of affordable housing.

The long-term solution lies in addressing the supply side of the equation. More homes need to be built, particularly in the entry-level segment, to meet the needs of first-time buyers. This will require not just an increase in construction activity, but also a reevaluation of zoning laws and building regulations that currently stymie development in many areas. For Black families and other marginalized communities, targeted policies aimed at closing the racial wealth gap and addressing discriminatory practices in the housing market will be essential. This includes expanding access to affordable credit, providing down payment assistance, and enforcing fair housing laws more rigorously.

Thus, the emergence of $1 million starter homes typically reflects the growing income inequality in the United States and highlights how the housing market has become increasingly inaccessible to significant segments of the population, such as young first-time buyers and Black families. The increasing difficulty of homeownership could lead to a future where it – and the economic security it provides – becomes a privilege reserved for a select few, thereby affecting economic inequality and social mobility.

How a young Singaporean investor bought $2M in condos by 24 amid U.S. market crash fears - Investmentals

[…] In a city known for its sky-high property prices, Singaporean investor Damien Tan, Chief Executive Officer at AIA Financial Advisers, stands out as a prime example of real estate acumen and strategic investment. At just 24, Tan has successfully mastered Singapore’s competitive real estate market, acquiring two high-value condominiums — one valued at S$1.25 million and another at S$1.26 million. His story is not just about personal success but also offers insights into the broader implications of real estate investment, particularly when compared to current fears surrounding the U.S. housing market. […]

July Saw Record Low Home Sales Despite 0.6% Gain, as 60,000 Buyers Exit Over Inflation Pressures - Investmentals

[…] sales, an indicator of future market activity, also showed an alarming trend. They dropped by 2.9% from June and 5.8% from the previous year, marking some of the most […]

US housing crisis reaches political boiling point as interest rates soar and the Fed’s limits become clear - Investmentals

[…] housing not only hampers individual wealth accumulation but also intensifies existing disparities within society. A major barrier to homeownership is the escalating cost of entry […]