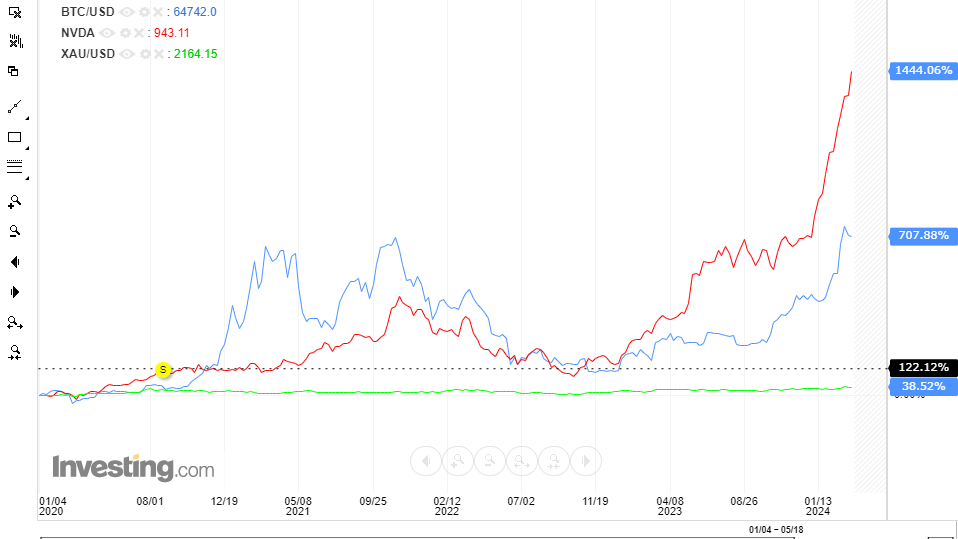

Over the last few years, Nvidia has shook the stock market as it transitioned from a chipset giant to an AI-powered chipset giant. Since 2020, Nvidia has significantly fortified its data center portfolio, with notable acquisitions like Mellanox Technologies ($7 billion deal) playing a pivotal role. This prompted investors to see Nvidia as a complete AI business platform with significant potential for growth. The company has shot up in value by a whopping 1444.06% during the time period from January 3, 2020 to March 24, 2024.

Cryptocurrencies, in parallel, reflected on their inherent nature, exhibiting substantial price volatility. The recent rise of Bitcoin, to a lesser extent, can be attributed to the increasing prominence of high inflation, as it is perceived as a means to safeguard against inflation. From 2020 up to now, Bitcoin has surged by 707.88%.

Meanwhile, good old gold has seen a steady increase of 38.52%. It’s always been seen as a safe bet when things get shaky in the economy.

Interestingly, following a brief consolidation late last year, NVIDIA’s bullish momentum at the onset of this year very closely correlated with that of Bitcoin.

In essence, some correlation between Nvidia and cryptocurrencies isn’t an unknown phenomenon. With the rise of digital currencies like Bitcoin, the demand for Nvidia’s GPUs have increased. Although GPUs weren’t initially intended for cryptocurrency mining, they’ve become one of the primary choices alongside ASICs for most miners.

But what exactly has fueled this heightened correlation between NVIDIA and Bitcoin in recent times? The key factor lies in Artificial Intelligence. While AI has been steadily gaining traction over the years, its burgeoning applications and advancements have reached new heights in 2024.

Learn about Nvidia’s new AI platform, omniverse here: Omniverse Platform for OpenUSD Development and Collaboration | NVIDIA

The growing use of AI has made more people want powerful computers, especially GPUs. These GPUs are really good at doing many tasks at once, which is super important for teaching AI and making decisions based on what it learned. So, because more and more people are using AI, they need these powerful GPUs. And because of this, the demand for GPUs has gone up a lot.

Speaking of cryptocurrencies, while the link with AI isn’t as direct as the one with GPUs, the broader tech landscape influenced by AI can contribute to market sentiment, potentially affecting its prices. For example, increased interest in advanced technologies like AI often signals optimism in tech sectors, including cryptocurrencies.

Nvidia is not shy about showing off as a GPU giant powered by AI. In the most recent GTC event, it showcased significant AI innovations, including dancing robots, after announcing the groundbreaking AI GPU, Blackwell. The company, in fact, is even using AI to manufacture chips now.

Cryptocurrency miners have recognized the potency of GPUs for AI-related computations and have consequently turned to them in droves. As a result, the intersection of AI and cryptocurrency mining has become a significant driving force behind the intensified correlation between Nvidia and Bitcoin.