The housing market in July experienced a paradox. Existing home sales saw a slight increase of 0.6% from the previous month, yet this modest gain occurred against the backdrop of the lowest July sales figures on record, dating back to 2012. The seasonally adjusted annual rate for home sales fell to 4.09 million units, reflecting a 2% year-over-year decline. This is the smallest number of sales recorded for July since data collection began over a decade ago.

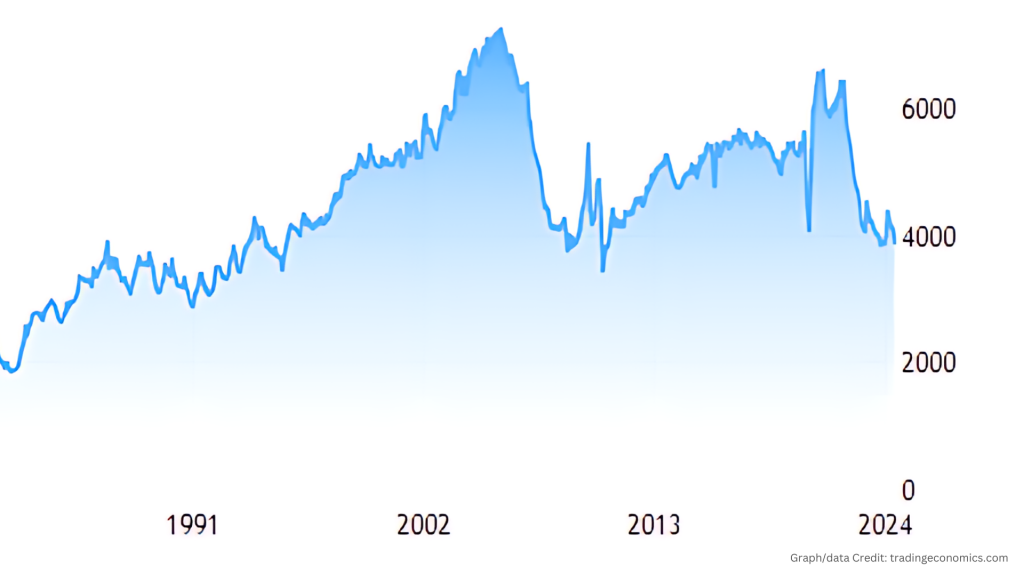

Pending sales, an indicator of future market activity, also showed an alarming trend. They dropped by 2.9% from June and 5.8% from the previous year, marking some of the most significant declines in nearly a year. This decline is a key indicator of decreasing buyer interest despite recent drops in mortgage rates. The average rate on a 30-year fixed mortgage fell to 6.49% in July, a significant drop from the peak of 7.22% seen earlier in the year.

So why are buyers staying on the sidelines? The answer is multifaceted. Although mortgage rates have decreased, high home prices remain a persistent barrier.

In July, the median sale price of homes rose to $439,170, up 4.1% from the previous year and only slightly below the all-time high set last month. This price pressure continues to strain potential buyers, despite the reduced cost of borrowing.

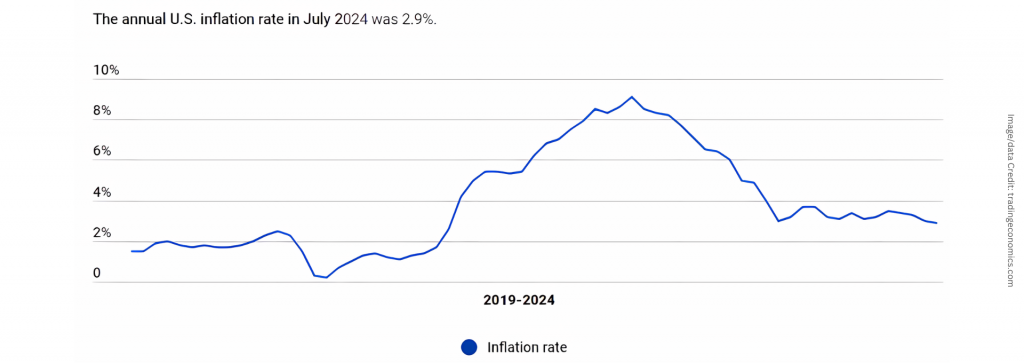

Economic uncertainty is another factor influencing buyer behavior. The political climate and inflationary pressures are making potential homebuyers wary. Even though inflation eased slightly in July to 2.9% from 3.0% in June, it remains a significant concern.

High inflation, coupled with a sluggish reduction in interest rates, contributes to a broader sense of uncertainty in the housing market.

Adding to the complexity, a record 60,000 buyers withdrew from their home-purchase agreements in July. This represents 16% of homes that went under contract, the highest cancellation rate for any July on record. This spike in cancellations is particularly notable in regions with rising housing inventories, such as Florida and Texas, where the glut of available homes has failed to attract buyers. In Tampa, for instance, 21.9% of contracts were canceled, reflecting the highest rate among major metropolitan areas.

In addition to high prices and inflation concerns, the housing market faces a structural shift. As observed in recent months, the housing market is transitioning from a seller’s market to a buyer’s market. Homes are lingering on the market longer, and sellers are receiving fewer offers. This shift is further highlighted by the increase in unsold housing inventory, which rose by 3.1% from the previous month.

The increase in inventory and the slow pace of price adjustments are contributing to the current buyer hesitation, as reported by coloradorealtors.com. With more homes available, buyers have greater negotiating power, but high prices and ongoing inflationary pressures limit their ability to capitalize on this. Also, the record high cancellation rates suggest that many buyers are not just holding off but actively reconsidering their home purchase decisions in the face of economic uncertainty.

The market currently shows signs of cooling; however, the overall environment suggests that while some buyers might find opportunities in increased inventory and reduced mortgage rates, many are choosing to wait for clearer signals of stability. Still, the persistence of high home prices and inflationary pressures suggests that the housing market is likely to experience continued volatility in the near term.

US economy’s 818,000 job deficit report reveals underlying economic vulnerabilities - Investmentals

[…] recession fears, the consequences of rate hikes aimed at curbing inflation, and the housing market crisis — are leading to in-depth discussions about existing economic policies and future […]