The United States faces a serious economic challenge with its rising national debt. Extending beyond government finances, this issue has posed a threat to the financial stability of households across the nation. This article will detail the effects of the increasing US national debt on household financial stability, supported by key data and trends.

As of the first quarter of 2024, total vehicle debt has surged by 84.7%, increasing from $875 billion in Q1 2014 to $1.616 trillion. This dramatic rise reflects a substantial escalation in auto loan debt, which now accounts for 9.2% of total American consumer debt, surpassing student loan debt, which stands at $1.595 trillion.

In comparison to the previous year, which recorded a $39 billion rise in U.S. household debt, the latest data reveals a broader and more troubling trend. While 2023 figures highlighted significant credit card debt at $1.1 trillion and auto loan debt at $1.6 trillion, the ongoing increase in vehicle debt underscores a notable shift in the debt landscape. Mortgages continue to dominate American consumer debt, representing 70.3%, yet the significant growth in auto loan debt signals a pressing financial challenge.

The rising proportion of auto loan debt relative to other types of consumer debt signals emerging financial strain that could jeopardize the long-term economic health of many households. Certain US cities are experiencing particularly severe conditions. WalletHub’s latest report shows Greensboro, North Carolina, at 7th and Raleigh, North Carolina, at 25th for increasing debt levels, with Durham and Charlotte also ranking prominently.

These rankings underscore regions where debt is increasing at an accelerated pace, which may signal significant financial instability for a substantial number of residents.

Boston experienced the most significant increase in consumer debt during the second quarter of 2024. The average credit card balance in Boston rose by 6% from Q1 to Q2 2024, reaching $9,096. Personal loan balances increased by 3.5%, while auto loan balances saw a more moderate rise of 1%, totaling $23,649. North Las Vegas, Nevada, and Madison, Wisconsin, also recorded significant increases in various forms of debt, which illustrates a broader trend of escalating household liabilities.

This rapid accumulation of debt poses significant risks. Higher debt levels can lead to financial strain for households, making it difficult for individuals to manage their finances effectively. As Cassandra Happe, a WalletHub analyst, notes, increasing debt isn’t always bad, but it becomes problematic when it accumulates too quickly for people to manage on-time payments. With high-interest rates, borrowing can become unsustainable, thus creating a vicious cycle of debt and financial instability.

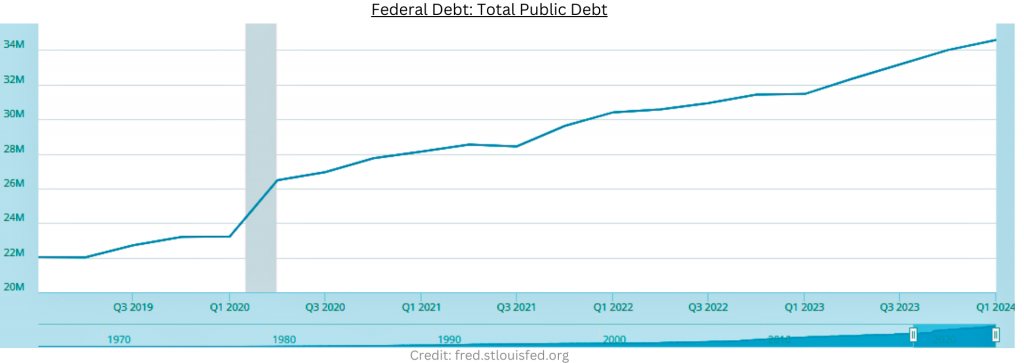

The national debt, which has ballooned to over $31 trillion, intensify these issues. Obviously, high national debt levels can lead to higher taxes and reduced public spending, both of which negatively affect households. Increased taxes, for instance, reduce disposable income and make it harder for families to save and invest; reduced public spending can lead to cuts in essential services, further straining household budgets.

Moreover, the national debt’s impact on interest rates cannot be overlooked. Excessive national debt can lead to higher interest rates as the government competes with the private sector for borrowing. This, in turn, increases the cost of borrowing for households, affecting everything from mortgages to auto loans to credit cards. As interest rates rise, so does the cost of servicing existing debt, which adds additional pressure on household finances.

This does not end here at all; the growing burden of debt also has significant psychological implications. Financial stress, according to a study by the National Library of Medicine, can lead to mental health issues, including anxiety and depression. This stress affects not only individuals but also their families and communities, creating a ripple effect that can impact productivity and overall well-being.

In response to these challenges, it is crucial for individuals to adopt prudent financial practices as advised by experts like Traci S. Williams, PsyD, ABPP, CFT-I. One approach is to focus on low-risk investments to grow savings. A relevant example is investing in certificates of deposit (CDs), which provide reliable, fixed-rate returns on a lump sum of money over a fixed period. High-yield savings accounts are another option, offering higher interest rates than regular savings accounts. US treasury bills, notes, and bonds are considered very low-risk investments, backed by the full faith and credit of the US government. Money market funds, which invest in short-term, low-risk assets, and fixed annuities, which guarantee a fixed rate of return, are also recommended.

These low-risk investment options offer a security blanket, ensuring that individuals do not lose their savings to market volatility. By investing wisely, households can build a financial cushion that helps them manage debt more effectively and mitigate the impact of economic uncertainties.

Another key strategy is to develop a viable payoff plan for existing debt. Focusing on paying down the highest-interest balances first while maintaining minimum payments on the rest can help reduce the overall debt burden. This approach, known as the debt avalanche method, minimizes the amount paid in interest over time and accelerates the path to becoming debt-free.

It is also important to be mindful of the types of debt one accrues. High-risk investments, such as those in foreign emerging markets, can offer significant returns but come with the potential for substantial losses. For most households, it is wiser to stick with low-risk investments that provide steady, reliable returns, ensuring financial stability in the long run.

Financial literacy plays a crucial role in managing debt and building financial resilience. Studies show that understanding the basics of personal finance – such as budgeting, saving, and investing – can empower individuals to make informed decisions. Educational resources and financial counseling services can provide valuable guidance by helping people manage complex financial situations and avoid common pitfalls.

Hence, amid concerns about a potential recession and a significant global financial crisis, the growing burden of the US national debt has far-reaching consequences for household financial stability. Cities like Boston, North Las Vegas, and Madison exemplify regions where debt is rising sharply, underscoring the need for prudent financial management.

With over $2.7 trillion in auto loans, credit cards, and personal loans, coupled with the rapid accumulation of new debt, households face significant financial challenges. Furthermore, the number of individuals not in the labor force but actively seeking jobs increased by 366,000 to 5.6 million, according to the July report of the U.S. Bureau of Labor Statistics.

The data is clear: the growing US national debt and rising household liabilities are critical issues that demand attention. Tackling these challenges directly allows individuals to protect their financial stability and support a more robust, resilient economy. If action is not taken in time, the situation could deteriorate, potentially leading to broader economic issues such as slower growth and increased financial insecurity within communities.

U.S. $1M Starter Homes Warn of Deepening Income Inequality and Emerging Housing Disparities - Investmentals

[…] practices in the housing market will be essential. This includes expanding access to affordable credit, providing down payment assistance, and enforcing fair housing laws more […]

US economy narrowly escapes crisis: the story behind the mini crash that didn't happen - Investmentals

[…] mounting debt, encompassing both corporate and government sectors, mirrors the conditions […]

Global financial 'time bomb': how geopolitical tensions, soaring debt, and conflicting central bank policies are fueling economic instability - Investmentals

[…] undermine financial stability. The U.S. and European economies, for instance, have amassed debt that strains their fiscal flexibility and hinders effective economic […]