NVIDIA, the leading chipmaker, has been soaring high in the tech world despite the recent turbulence in international relations. With its revenue doubling in the last fiscal year and projected to rise even further, NVIDIA seems to be defying odds, particularly with its reliance on Taiwan Semiconductor Manufacturing Co Ltd (TSMC) for chip production.

Last August, tensions between the US and China intensified when the US banned American investments in specific areas of China’s advanced technology field, including artificial intelligence. This move, aimed at protecting national security interests, added more strain to the already complicated relationship between the two superpowers.

Before we go any further, I would like to tell you about Seeking Alpha.

Seeking Alpha is a top-notch tool for investment analysis. It’s widely regarded as one of the best platforms available for in-depth insights into various investment opportunities. So, make sure to check it out.

When this news broke, many anticipated a significant impact on NVIDIA and other US tech giants. However, the company managed to weather the storm, and its stocks consolidated rather than plummeting.

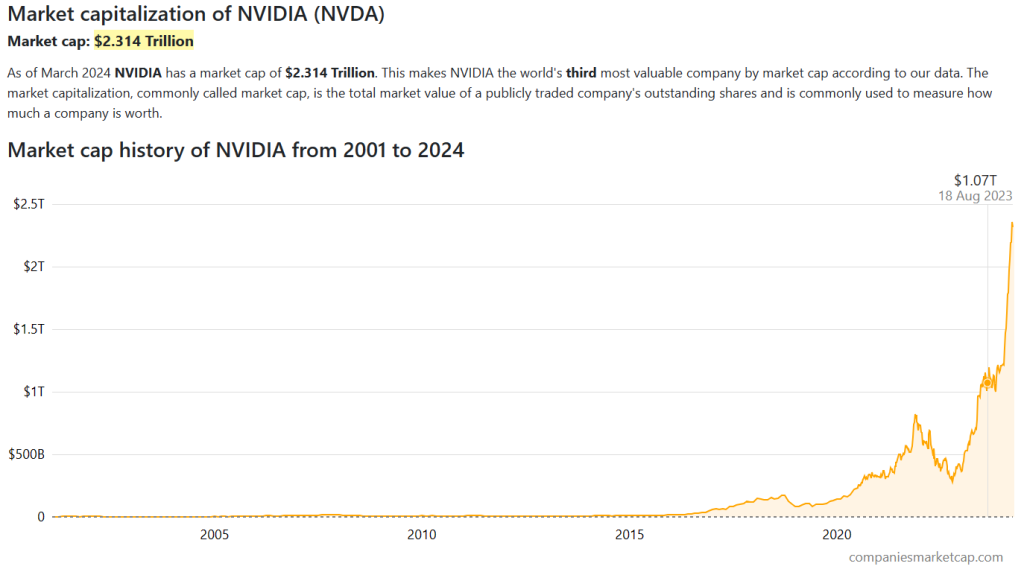

As an immediate effect, this development prompted a well-deserved 6-month consolidation period for NVIDIA after it reached the $1 trillion mark, rising from $360 billion at the beginning of that year.

But as soon as we stepped into 2024, NVIDIA’s market capitalization started its unstoppable surge, quickly reaching $2 trillion in just 3 months. This removed any remaining uncertainties about the ban affecting the chipset giant.

Interestingly, this bullish trend persisted despite the renewed efforts of U.S. lawmakers in January (2024) to pass bipartisan legislation aimed at restricting American investment in Chinese technology. During a hearing on the legislation, House Foreign Affairs Committee Chairman Michael McCaul highlighted these concerns, stressing that the proposed bill, H.R. 6349, is critical for targeting specific technology sectors such as artificial intelligence and quantum computing, which are fueling China’s military advancements and surveillance capabilities.

It’s also important to note that NVIDIA is now an AI-powered chipset giant. Through initiatives like Omniverse, ACE, and a host of other AI systems, the company has solidified its position as a leader in AI technology. Not only is NVIDIA coming up with groundbreaking advancements in AI, but it’s also using AI to accelerate the manufacturing process of GPUs, crucial components essential for training AI models.

Recommended Read: Nvidia CEO Jensen Huang announces new generation AI chips and software

TSMC, based in Taiwan, stands as the globe’s biggest semiconductor foundry, crucial not just for NVIDIA but for numerous other tech giants reliant on its chip manufacturing capabilities. Despite Taiwan’s close ties to China geopolitically, and despite China being its biggest trading partner, Taiwan operates independently in terms of technology and business. The recent reactions from the Taiwan-reliant US chipset markets only reinforce this autonomy.

Do people tend to love overpaying for stocks? - Investmentals

[…] significant growth potential or disruptive innovations. A current example is Nvidia, which recently joined the $3 trillion club. If the company’s future earnings and […]

US economy narrowly escapes crisis: the story behind the mini crash that didn't happen - Investmentals

[…] like Nvidia, once darlings of the market, saw their valuations soar by over 1,000% in just two years. […]