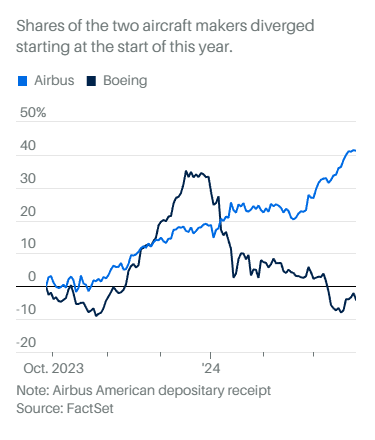

In recent times, there has been a noticeable discrepancy between the stock performances of Airbus and Boeing. This shift was triggered when the Federal Aviation Administration (FAA) ordered most Boeing 737 Max 9 planes to be temporarily grounded on Saturday, January 6th.

The underlying causes of this trend have been developing for several years. Two devastating crashes involving Boeing 737 Max planes occurred within a span of almost five months: the first off the coast of Indonesia in October 2018, followed by another in Ethiopia in March 2019. These tragic events resulted in the loss of 346 lives.

Interestingly, and as noted by Airbus CEO Guillaume Faury, the thorough documentation of these problems not only hurts Boeing’s reputation but also casts a shadow over the entire aerospace industry. While it’s partly true, the fact remains that Airbus has become the main beneficiary of its competitor’s misfortunes… or, at least in the short term.

When considering the long-term outlook, the competitive milieu among these aviation powerhouses might experience notable shifts.

Before we go any further, I would like to tell you about Seeking Alpha.

Seeking Alpha is a top-notch tool for investment analysis. It’s widely regarded as one of the best platforms available for in-depth insights into various investment opportunities. So, make sure to check it out.

Again, Boeing’s problems have undeniably given Airbus a short-term advantage. The grounding of the 737 MAX and subsequent production halts left a gap in the market, enabling Airbus to benefit from Boeing’s misfortunes by securing more orders for its aircraft models.

Outpacing Boeing in both orders and deliveries, particularly in the narrow-body aircraft market dominated by the Boeing 737 MAX and Airbus A320 family, Airbus has garnered a commanding 61% share of this segment. This ascendancy is further underscored by the disparate trajectories of their stock performances since the second week of January 2024, with Airbus surging while Boeing flounders.

However, Boeing’s recent challenges have far-reaching consequences that extend well beyond immediate gains for Airbus. The aerospace industry operates as a tightly interconnected ecosystem, where the fortunes of one major player can profoundly affect the entire supply chain.

Furthermore, the convergence of global challenges such as climate change and sustainability will continue to pressurize collaborative efforts within the aerospace industry. Both Boeing and Airbus face similar challenges in developing more fuel-efficient aircraft, reducing emissions, and adopting sustainable practices. In this context, adversarial competition may give way to cooperative partnerships and industry-wide initiatives aimed at addressing shared challenges for the greater good.

When Boeing experiences disruptions in its operations, for example, the immediate effects might be felt by its suppliers and financial backers only. However, the broader consequence lies in the harm to a major industry player’s reputation and the loss of trust in its dedication to safety. This tarnished image could potentially extend beyond Boeing itself. The crisis surrounding the 737 MAX exposed flaws in regulatory oversight and corporate governance, urging demands for significant reforms. The resulting loss of public trust could hamper innovation, shake investor confidence, and even stifle the long-term growth potential of the airline industry.

Of course, Airbus’s sustained success isn’t solely contingent upon Boeing’s ups and downs. Rather, it relies on Airbus’s own capacity to innovate, evolve, and lead in the aerospace industry. Boeing elements aside, the France-based aerospace giant currently has its own big set of issues to deal with. The challenge Airbus is facing is particularly in managing a growing number of orders that are yet to be fulfilled. If not addressed promptly, this backlog could extend into the 2030s. This challenge comes at a time when United Airlines Holdings is urgently seeking Airbus jets to compensate for the delayed delivery of its Boeing 737 Max 10 orders, which are at least 5 years behind schedule.

Currently, Airbus holds the 93rd position globally in terms of market capitalization, with a value of $145.86 billion. In contrast, Boeing ($114.4 billion) sits in 132nd place on the list.