Nancy Pelosi’s vehement objection to California’s Senate Bill 1047, which seeks to regulate advanced artificial intelligence (AI) systems, has generated key concerns about its potential impact on the tech industry. Pelosi, in a statement on Friday, warned that the bill could stifle innovation, describing it as “well-intentioned but ill-informed.”

Pelosi’s criticism is so bitter that it has ignited ‘tech-over-life’ concerns, such as the risk of overregulation stifling technological progress and economic growth. Consequently, investors and stakeholders have become increasingly aware of the potential impact on investment strategies and tech company valuations, raising questions about the future of AI regulation and its possible disruptions.

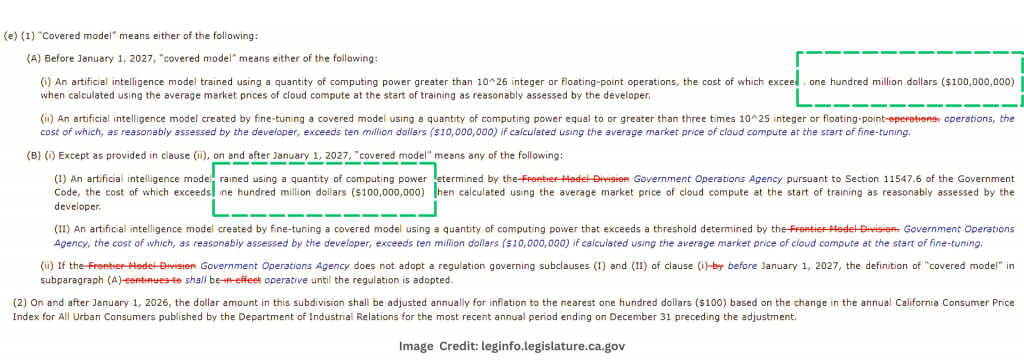

SB-1047, known as the Safe and Secure Innovation for Frontier Artificial Intelligence Models Act (2023-2024), was introduced on February 7 by California State Senator Scott Wiener. This legislation aims to impose rigorous safety standards on large AI models with at least 1,026 floating-point operations per second (FLOPS) and development costs exceeding $100 million. It mandates stringent security protocols and regular independent audits for these AI systems. After significant amendments, the bill has passed the Assembly Appropriations Committee and is set for a final vote by August 31.

Pelosi’s criticism highlights a broader debate on AI regulation and its impact on the tech industry’s growth and innovation. She argues that while the bill intends to safeguard consumers and ensure safety, it could inadvertently obstruct innovation and compel tech companies to relocate or scale back operations.

In addition, Pelosi’s position is viewed as a strategic effort to enhance her influence and safeguard her political legacy amid the ongoing political contest involving her daughter Christine Pelosi, a leading Democratic strategist, and potential challengers for her San Francisco House seat.

The former Speaker’s criticism is noteworthy given her investment portfolio, which includes significant holdings in AI-related companies; Pelosi and her husband, Paul Pelosi, have investments in NVIDIA, Broadcom, Palo Alto Networks, and Databricks – companies poised to benefit from AI advancements.

Pointing towards her husband’s substantial investments in the sector, critics are arguing that Pelosi’s objection to SB-1047 may be influenced by her financial interests.

Supporters of SB-1047, including California State Senator Scott Wiener, insist that the bill is crucial for addressing the safety risks associated with advanced AI models. Wiener argues that innovation and safety are not mutually exclusive, countering Pelosi’s claim that achieving innovation requires leaving safety entirely to technology companies and venture capitalists.

“The bill requires only the largest AI developers to do what each and every one of them has repeatedly committed to do: Perform basic safety testing on massively powerful AI models. I’ll repeat myself: Each and every one of the large AI labs has promised to perform the tests that SB-1047 requires them to do – the same safety tests that some are now claiming would somehow harm innovation,” said Wiener in a statement.

Along with Wiener, Geoffrey Hinton and Yoshua Bengio also reinforce the importance of managing the risks of advanced AI. The legislation, as they say, could serve as a model for other jurisdictions, setting standards that balance innovation with safety.

On the other hand, this support is countered by strong opposition from startup founders and industry leaders, who argue that the bill’s requirements could unfairly burden smaller companies and drive innovation overseas.

“The bill as currently written would be ineffective, punishing of individual entrepreneurs and small businesses, and hurt California’s spirit of innovation,” said US Congressperson Ro Khanna, who represents Silicon Valley.

In line with this, Anjney Midha, a General Partner at Andreessen Horowitz, has also voiced opposition to provisions of the bill, suggesting that it could have detrimental effects on the tech sector.

“It’s hard to overstate just how blindsided startups, founders, and the investor community feel about this bill,” Midha said during an interview posted on his company’s website.

The bill’s provisions include several key amendments that aim to address industry concerns. Notably, criminal penalties for perjury have been removed, and the bill now applies only civil penalties for false statements. The bill mandates rigorous safety protocols for advanced AI models – those with substantial computational power and development costs exceeding $100 million.

However, the proposed new regulatory body, the Frontier Model Development (FMD), has been removed, with enforcement responsibilities shifted to the Attorney General’s office. Also, the legal standards for developer compliance have been changed from “reasonable assurance” to “reasonable care,” aligning with established common law practices.

This change could influence how developers are expected to demonstrate their commitment to safety and compliance by altering the enforcement framework and the legal standards they must meet.

Another point of debate is the bill’s introduction of annual third-party audits and detailed compliance requirements for advanced AI systems.

In a situation where there is already extensive uncertainty about AI’s economic impact and a lack of empirical data on its effects, as research suggests, such high-level debates about SB-1047 point to the broader challenges of regulating AI globally.

This heightened uncertainty can further complicate the regulatory environment, as policymakers are obliged to balance the need for safety with the desire to promote innovation. Nations in the world have adopted varying approaches to AI regulation, reflecting their unique political and economic contexts.

In the U.S., the ongoing discourse over SB-1047 has exposed the tension between regulatory management and the need to foster a highly competitive tech sector. Given this tension, the bill’s potential impact on California’s tech industry, and by extension, on tech stocks, is a crucial consideration for investors. In this context, the controversy surrounding Pelosi’s criticism and the bill’s provisions reflects the broader uncertainties and challenges facing the AI sector.

For investors, these concerns translate into a primary fear that the regulations might deter investment and shift technological development offshore, potentially weakening California’s competitive edge in the tech sector.

This is why investors are cautious about the bill’s potential effects on tech stock valuations and are closely monitoring how regulatory changes might influence investment returns.

California’s SB-1047 has advanced amid federal inaction on AI regulation, with the state’s initiative seeking to address the risks posed by rapidly advancing AI technologies and to foster innovation while the US Congress remains stagnant on technology legislation.

Debating SB 1047: Can California Harmonize AI Innovation and Safety? - Investmentals

[…] including former Speaker Nancy Pelosi, argue that SB 1047 could stifle innovation and push AI development away from […]