The Federal Reserve has finally cut interest rates by half a point, prompting immediate criticism from former President Donald Trump. He said that this significant reduction either indicates a “very bad” economy or reflects political maneuvering. This raises an important question: is Trump’s claim accurate?

The Federal Reserve reduced its benchmark interest rate by 50 basis points on Wednesday, the first major rate cut since the pandemic began. The new range for the rate is between 4.75% and 5%. This move, according to Fed officials, is intended to ease financial pressure on businesses and households and support the job market, which has shown signs of slowing down. Given the upcoming presidential election, this rate cut has sparked debate about its timing and motives.

Donald Trump has criticized the Federal Reserve’s decision, stating that the large rate cut indicates either a severe economic problem or political maneuvering. Trump has previously expressed dissatisfaction with Fed Chair Jerome Powell, accusing him of political bias and poor economic management. “It looks to me like he’s trying to lower interest rates for the sake of maybe getting people elected, I don’t know,” Trump said in an interview with Fox Business Network’s Maria Bartiromo earlier this year.

Despite initially nominating Powell in 2017, Trump has been critical of his decisions, particularly regarding interest rates during trade conflicts and economic uncertainties.

Economic data, however, presents a more optimistic view. Recent reports show that consumer spending remains strong, despite a slight slowdown. Retail sales rose by 0.1% in August, which, while less than July’s 1.1% increase, still exceeded economists’ expectations. This growth is significant because consumer spending drives two-thirds of U.S. economic activity. Although the unemployment rate has increased to 4.2% from 3.8% over the past year, it remains relatively stable and manageable.

Over the past year, falling inflation, coupled with stable unemployment rates, has resulted in higher real wages and incomes for American workers.

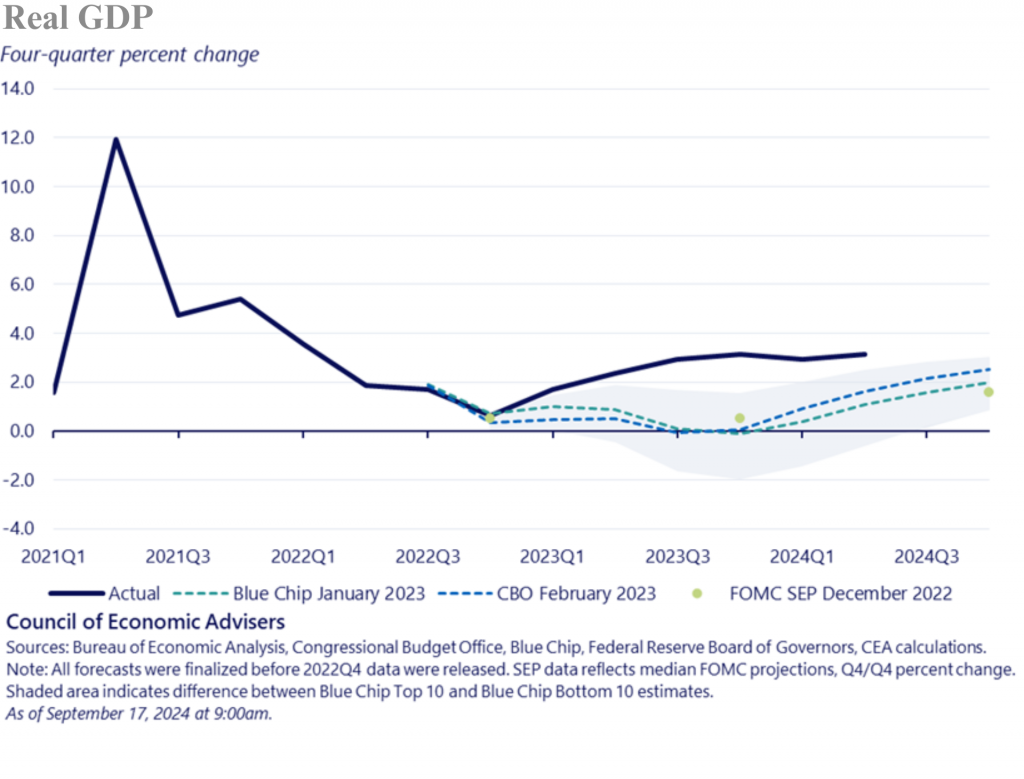

By the final quarter of 2023, real disposable personal income per capita was $1,100 above forecasts, which has supported strong consumer spending and robust real GDP growth. From late 2022 to mid-2024, real GDP grew by 4.3%, substantially exceeding the 1.2% and 0.7% increases predicted by the CBO and Blue Chip Consensus, respectively.

The Federal Reserve’s decision to lower interest rates by half a point aims to encourage spending and investment while balancing inflation. The latest inflation rate is 2.5%, close to pre-pandemic levels. The Fed’s move is designed to prevent a further slowdown in economic growth and maintain job market stability.

In the past, the U.S. economy has defied many predictions. Analysts had expected high inflation would lead to a significant rise in unemployment, but this has not been the case. Effective policies by the Biden-Harris Administration, including efforts to resolve supply chain issues and support household finances, have helped reduce inflation without causing major job losses. The economy has managed to lower inflation while keeping unemployment relatively low, exceeding many forecasts.

Trump’s view that the Fed’s rate cut is politically motivated or a sign of economic failure does not fully consider the broader economic context. The Federal Reserve’s actions are part of a strategy to address immediate economic challenges while promoting long-term stability. The ongoing strength of consumer spending and the continued reduction in inflation suggest that the rate cut is a measured response to current economic conditions rather than a sign of political interference.

Trump’s criticism of the Federal Reserve’s rate cut underscores the broader political and economic debates; however, the Fed’s decision is more about addressing current economic pressures than signaling a failing economy or political maneuvering.

What Traders Can Expect for Monday’s Market Opening Amid Bigger Fed Rate Cut Action - Investmentals

[…] movements in global markets as the U.S. Federal Reserve implemented its first interest rate cut since 2020. This half-point cut, steeper than many had anticipated, has triggered a […]

Why the S&P 500 is diverging from Trump's election odds - Investmentals

[…] the market remains insulated from political uncertainty, focusing instead on the Federal Reserve’s rate cuts and monetary easing, both of which have bolstered capital-intensive sectors like […]