Biden’s administration forgives $39B student debt for 800,000 borrowers, rectifying long-standing system flaws.

Economic empowerment surges as relieved borrowers redirect resources to investments, driving growth.

Legal battles and Supreme Court’s rejection of broader plan emphasize administration’s adaptable commitment.

Tangible impacts can be seen as debt relief frees borrowers like Scalona, fueling aspirations and reshaping lives.

President Joe Biden’s administration, strongly determined despite a challenging legal dispute, ultimately announced last month the approval of over $116 billion in debt cancellation for 3.4 million Americans, representing a transformative stride toward economic empowerment. As a part of the program, the recent decision to forgive $39 billion in student loan debt for more than 800,000 borrowers signifies a crucial leap towards reducing the burden that has plagued millions of borrowers and has the potential to drive economic growth and empowerment.

The foundation of this initiative lies in addressing the flaws embedded in the Income-Driven Repayment (IDR) plans, which were intended to offer debt forgiveness after 20 or 25 years of consistent payments. However, due to a series of administrative errors, as Pres. Biden said in a statement, more than 804,000 borrowers never received the credit they rightfully earned, and their debt remained unrelieved, despite decades of payments. President Biden’s commitment to rectify this injustice is evident, as he stated, “I was determined to right this wrong,” and with the recent announcement, borrowers who have been repaying for over two decades will finally witness the cancellation of their student debt.

There are profound economic implications of this debt relief initiative. For instance, borrowers who have struggled for years to manage their student loan payments can now redirect their financial resources towards investments that can stimulate economic growth. This newfound economic flexibility can lead to increased consumption, investments in housing, entrepreneurship, and other wealth-generating activities. As these borrowers are unburdened from the weight of student debt, they are empowered to pursue their economic aspirations, ultimately fostering a more robust and dynamic economy.

In addition, this initiative aligns with President Biden’s broader efforts to bolster economic empowerment through education. The expansion of Pell Grants to assist families with lower incomes and the overhaul of the Public Service Loan Forgiveness program demonstrate a comprehensive strategy to enhance access to education and alleviate the financial strain on borrowers. These multifaceted approaches are not only crucial for individual financial well-being but also essential for creating an educated and skilled workforce that can contribute to the nation’s economic competitiveness on a global scale.

The recent legal battles surrounding this debt relief plan underscore its significance. Despite challenges from conservative groups asserting constitutional violations, the dismissal of the lawsuit signifies the resilience of the administration’s commitment to addressing student debt.

Michigan District Judge Thomas Ludington’s recent ruling, which stated that the groups lacked standing for their complaint and that their alleged injuries were insufficient, affirms the legal foundation of the plan and paves the way for much-needed economic relief for hundreds of thousands of borrowers.

This legal victory reinforces the notion that responsible and targeted government intervention can indeed drive economic empowerment without infringing on individual liberties.

Meanwhile, it is also essential – to some extent – to acknowledge the skepticism and concerns that have arisen in the wake of the Supreme Court’s decision to strike down a broader student debt forgiveness plan earlier this year. Millions of Americans were left disappointed and anxious, as the ambitious attempt to forgive $430 billion in student debt faced legal challenges.

“It is a real burden for me to know that I carry that much from one year of school,’ latimes.com quoted Mimi Hoang, a 20-year-old with $30,000 in student debt taken to pay for her first year at Southern Oregon University.

She initially rejoiced when President Biden announced plans last year to cancel thousands of dollars in student debt, but her sentiment changed after the court’s order. “It’s something that still follows me throughout my day-to-day life,” Hoang said. “It fills me with a lot of anxiety and stress.”

Against the backdrop of this harsh reality, the recent endorsement of the $39 billion relief plan showcases the administration’s flexibility and openness to pursuing alternate avenues for economic empowerment. President Biden’s willingness to pivot and seek legal avenues within the Higher Education Act of 1965 signifies a determined commitment to provide relief to as many borrowers as possible.

As the process of debt cancellation unfolds, it is equally essential to consider the solid impact on borrowers’ lives. Borrowers will experience a noticeable reduction in their financial obligations, enabling them to redirect resources towards meaningful endeavors. In this context, Tim Scalona’s story, published on July 5, 2023, and written by Ava Sasani for the Guardian, serves as a poignant illustration of the transformative power of debt relief.

“This decision is a slap in the face to millions of Americans who, like me, were told to pursue college and dream of a brighter future, and are now punished for doing so,” the Guardian quotes Tim Scalona as saying. As a law student at Suffolk University in Boston who will graduate with a substantial burden of $150,000 in student loans, Scalona, who spent months bracing for the ruling, encapsulates the struggles faced by many in pursuit of higher education.

The economic liberation resulting from debt forgiveness can potentially reshape the trajectory of countless lives like Scalona’s, allowing individuals to pursue their ambitions without being shackled by the burden of debt. And, the resolute decision of President Biden to provide substantial relief for over 800k borrowers, seen by many, including Scalona, as a testament to his commitment to economic empowerment and equal opportunity. For them, this initiative not only corrects longstanding administrative failures but also paves the way for a brighter economic future for countless individuals.

The combination of targeted relief measures, legal resilience, and adaptability in the face of challenges underscores the administration’s dedication to fostering a more economically empowered society. As borrowers experience the tangible benefits of debt cancellation, the ripple effects are poised to drive consumption, investment, and entrepreneurship, ultimately shaping a more resilient and dynamic economy.

Significant for economic empowerment

As the nation witnesses the gradual implementation of this debt relief plan, it will be crucial to recognize the multifaceted benefits that will ripple through various sectors of the economy. The economic empowerment bestowed upon borrowers will likely lead to increased consumer spending, driving demand for goods and services across industries. This surge in demand can create a domino effect, encouraging businesses to expand operations, hire more employees, and contribute to overall economic growth.

The significance of this initiative becomes even more pronounced when considering the broader context of a staggering amount of student debt’s impact on individuals and the economy.

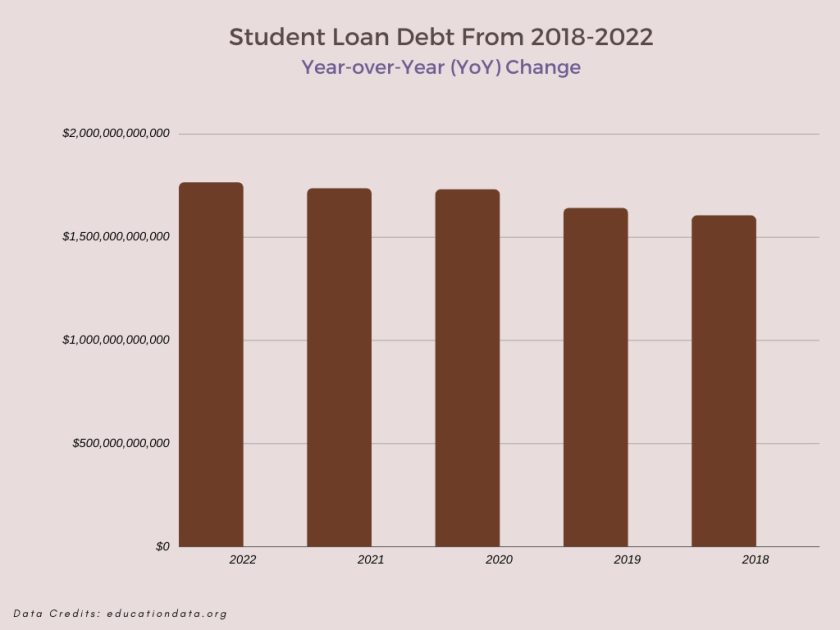

From 2018 to 2022, student loan debt in the United States experienced consistent growth. By 2022, the total student loan debt had reached $1.76 trillion, with a year-over-year increase of 1.66%. The preceding years also showed a similar trend, with the debt rising from $1.60 trillion in 2018 to $1.73 trillion in 2021. And, data for the second quarter of 2023 indicate a debt of $1.6445 trillion, marking a 1.53% increase compared to the previous quarter, and $1.6354 trillion for the first quarter, reflecting a 1.81% rise.

As the figure shows, the United States has been struggling with $1.75 trillion student debt crisis, a burden that has constrained the financial flexibility of millions of borrowers. The student loan debt increased to $1,644.5 billion in Q2 2023, marking a 1.53% rise from the previous quarter’s $1,635.4 billion in Q1 2023. In such an overwhelmingly challenging situation, the relief provided through this initiative can be a catalyst for breaking this cycle of debt and reshaping the financial trajectories of numerous households.

In addition to immediate economic benefits, the debt relief plan aligns with President Biden’s vision for a more equitable and accessible education system. The expansion of Pell Grants and the enhancement of the Public Service Loan Forgiveness program signify a commitment to removing barriers that hinder educational attainment and career advancement. By minimizing the financial strain on borrowers, the administration is fostering an environment where individuals can pursue higher education without the constant shadow of otherwise unconquerable debt.

The concept of economic empowerment through debt relief is not confined to individual borrowers; it also extends to the broader societal landscape. As borrowers are unburdened from student debt, they are more likely to engage in entrepreneurial endeavors, invest in innovative projects, and explore avenues that may have previously been financially prohibitive. This influx of entrepreneurial activity can invigorate sectors such as technology, healthcare, and renewable energy, spurring innovation and contributing to long-term economic vitality.

Critics may raise concerns about the fiscal implications of such a debt relief initiative. House Minority Leader Kevin McCarthy then tweeted: “Biden’s debt transfer scam will make inflation even worse and does nothing to stop the runaway cost of college for most families.”

Another criticism of the president’s plan is that it’s “unfair” to those who worked diligently to pay off their student loans.

“President Biden’s announcement that he intends to cancel student loan debt is irresponsible, unfair, and deeply cynical,” Senator Richard Burr, the top Republican on the Senate Health, Education, Labor and Pensions Committee, said last August.

Similarly, right after President Biden’s announcement of the student loan cancellation plan, Texas GOP Senator Ted Cruz criticized it during a press conference on hurricane systems in Galveston. “What President Biden has in effect decided to do is to take from working class people,” Cruz said.

“To take from truck drivers and construction workers right now, thousands of dollars in taxes in order to redistribute it to college graduates who have student loans. “

Despite these criticisms, when viewed through a comprehensive economic lens, the potential benefits of increased consumer spending, economic expansion, and the cultivation of an educated and skilled workforce can contribute to higher tax revenues. This, in turn, can lead to reduced reliance on social safety nets. The economic gains generated by empowered borrowers can potentially offset the initial costs of debt relief, creating a virtuous cycle of economic growth.

The full impact of President Biden’s transformative move remains to be seen, yet the implementation of a multi-billion-dollar student debt relief plan clearly signifies a pivotal milestone. As intended, this initiative rectifies past injustices and stimulates economic growth, innovation, and societal advancement, empowering borrowers to propel consumption, entrepreneurship, and investment, thereby forging a dynamic and equitable future for America.

Scam in student debt forgiveness fools millions by false hope emails - Investmentals

[…] Biden’s plan, which aimed to write off up to $10,000 per applicant making up to $125,000 and up to $20,000 for Pell Grant […]