With just hours remaining before what is shaping up to be one of the most significant Federal Reserve meetings in years, market participants are on edge. Speculation has reached a fever pitch. The central debate revolves around whether the Federal Open Market Committee (FOMC) will opt for a 25-basis-point cut or a more aggressive 50-basis-point reduction in interest rates. Beyond the immediate decision, deeper uncertainty surrounds the future trajectory of monetary policy, driving wild swings in stock prices and heightening volatility across financial markets.

Options traders, in particular, have significantly increased their bets on substantial market swings. According to a recent report from Bank of America, traders are exhibiting the highest levels of uncertainty seen in nearly a decade. This sentiment is vividly illustrated by the surge in the price of an at-the-money straddle on the S&P 500—a strategy that benefits from major price movements in either direction. This approach mirrors the heightened demand observed during the collapse of Silicon Valley Bank in March 2023. Now, traders are bracing for a similar episode of volatility as they hedge against potential market turbulence on Fed day.

Interest-rate futures have fluctuated significantly over recent sessions, underscoring the difficulty traders face in reaching a consensus on the Fed’s forthcoming decision. The CME FedWatch tool has revealed a notable increase in the probability of a 50-basis-point rate cut, rising from 62% to 65% within a single day. In contrast, the likelihood of a more modest 25-basis-point reduction stands at 35%, reflecting considerable uncertainty. This is the scenario that has prompted a rise in volatility measures as traders prepare for any potential outcome.

At the heart of this uncertainty lies a fundamental dilemma for the Federal Reserve: how to balance the risks of reigniting inflation against the possibility of inducing a recession. Recent data shows that the Fed’s preferred inflation measure has declined from 3.3% to 2.5%, while the unemployment rate has increased from 3.5% to 4.2%. Although these figures suggest that inflationary pressures are easing, they also indicate a weakening labor market. Consequently, the Fed is to encounter the challenge of avoiding overly aggressive rate cuts that could rekindle inflation while also steering clear of excessive caution that might exacerbate economic slowdowns.

“For the Fed, it comes down to deciding which is a more significant risk — reigniting inflation pressures if they cut by 50 basis points, or threatening recession if they cut by just 25 basis points,” said Seema Shah, chief global strategist at Principal Asset Management. What Shah’s statement indicates is the Fed’s delicate position that emphasize the minimal margin for error in their decision-making process.

Mark Zandi, chief economist at Moody’s Analytics, has also advocated for a more aggressive rate cut. “They have achieved their mandate for full employment and inflation back at target, and that’s not consistent with a five-and-a-half percent funds rate target. So, I think they need to normalize rates quickly and have a lot of room to do so,” CNBC reported, quoting Zandi. Zandi’s perspective reflects a more dovish stance within the market; accelerated normalization of rates may mitigate further economic damage.

And the uncertainty extends beyond Wall Street traders and reaches the policymakers themselves.

“My guess is they’re split. There’ll be some around the table who feel as I do, that they’re a little bit late, and they’d like to get on their front foot and would prefer not to spend the fall chasing the economy. There’ll be others that, from a risk management point of view, just want to be more careful,” noted Former Dallas Fed President Robert Kaplan, pointing to the internal division within the FOMC. Kaplan’s observations indicates that the forthcoming decision could be one of the most contentious in recent history.

This internal division among Fed officials has intensified market uncertainty, as traders attempt to predict which faction will ultimately influence the decision. Will the Fed adopt a cautious stance with a 25-basis-point cut, or will it respond to calls for a more aggressive 50-basis-point reduction? The outcome of this decision will have profound implications for both the economy and financial markets.

The Dot Plot and Economic Projections and Stock Market Reaction

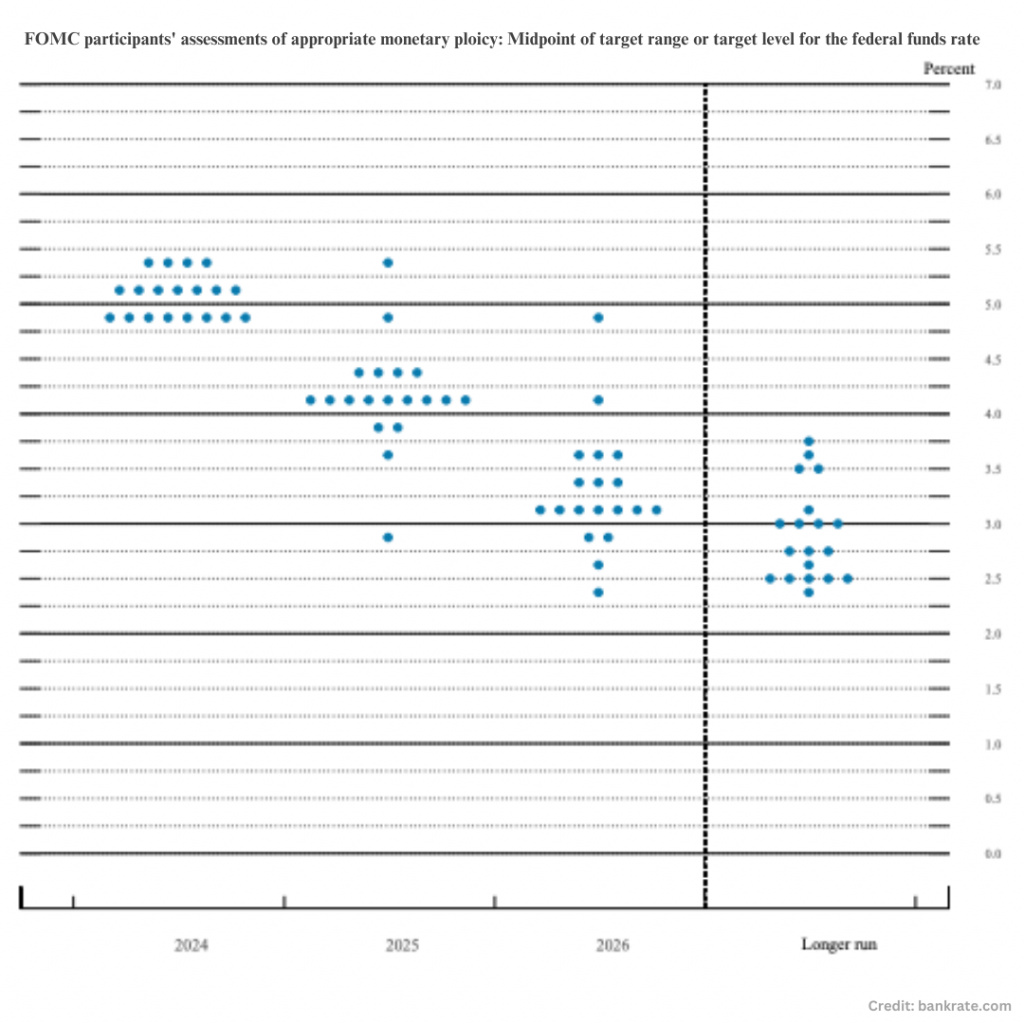

Beyond the immediate rate decision, traders and analysts will also be closely observing the Fed’s updated economic projections, including the much-anticipated “dot plot” – a chart that records each Fed official’s projection for the central bank’s key short-term interest rate. The dot plot will provide crucial insights into the Fed’s longer-term outlook. In June, the FOMC projected only one rate cut through the end of the year, but expectations have shifted significantly since then.

Many analysts now anticipate that the Fed may expedite its rate-cutting timeline, with markets pricing in the possibility of up to five rate cuts by the end of 2025. Such a shift would represent a substantial change in monetary policy and could indicate that the Fed anticipates a pronounced economic slowdown in the coming months.

Zandi, however, has warned against these projections. “That feels overly aggressive, unless you know the economy is going to start to weaken more significantly.”

Zandi’s comments underscore a growing disconnect between market expectations and the Fed’s official stance. While traders may be pricing in a swift series of rate cuts, the Fed has remained more conservative in its projections, suggesting a reluctance to implement rate reductions too hastily.

The stock market has already started to react to the uncertainty surrounding the Fed’s decision. On Tuesday, U.S. stock futures saw gains, with the Dow Jones Industrial Average (YM=F) increasing by 0.2%, the S&P 500 (ES=F) rising by 0.3%, and the Nasdaq 100 (NQ=F) advancing by 0.4%. Technology stocks, in particular, have driven this rally, as investors anticipate that lower interest rates could benefit the sector.

Notably, Intel (INTC) experienced a rise in its shares following the announcement of a multibillion-dollar deal with Amazon for AI chips. Similarly, Microsoft (MSFT) bolstered market optimism with its $60 billion share buyback and a 10% dividend increase. These positive developments have helped to restore confidence in beleaguered tech stocks, even as the broader market remains unsettled ahead of the Fed’s decision.

The Fed’s decision—whether a cautious 25-basis-point cut or a more aggressive 50-basis-point reduction—will have significant consequences for the stock market and the broader economy, exerting an effect on whether current economic uncertainties are eased or heightened.