Prices at the pump surged by 3.8% from the previous month.

According to recent findings from the Bureau of Labor Statistics (BLS), the uptick in February inflation can be primarily attributed to a notable spike in gas prices, causing a noteworthy surge in the Consumer Price Index. The latest CPI data released on Tuesday showed a 0.4% increase from the previous month and a 3.2% surge over the last twelve months.

Gasoline prices, in particular, saw a big increase, going up by 3.8% compared to the previous month. This change is quite different from the 3.3% decrease seen in January. Before seasonal adjustments, the BLS reported a 4.3% increase in gasoline prices for February. These energy price hikes led to February’s acceleration, contrasting with January’s 0.3% month-over-month increase and 3.1% annualized inflation rate.

While gas prices increased, other components within the energy index, such as natural gas and electricity, also rose. However, the bigger picture shows that the energy index fell by 1.9% over the past year. Only electricity saw a rise of 3.9% year-over-year. This context highlights that energy prices are not consistently driving inflation upward. Also, despite the February spike, the overall inflation rate remained relatively moderate. Long-term trends show that inflation has not consistently surged.

Behind the ongoing energy price shifts lies the movement in crude oil futures. Prices reached a high for 2024 of over $80 per barrel in early March before settling a bit lower for West Texas Intermediate (WTI) and Brent, the international benchmark, at around $77 and $83 per barrel, respectively. This volatility was partly due to OPEC+ extending output cuts of 2.2 million barrels per day into the second quarter, affecting market expectations and contract prices by the end of February.

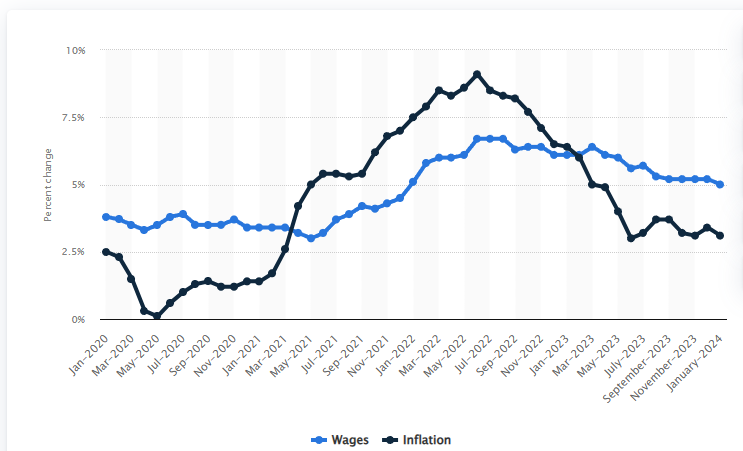

While gas prices indeed contributed to the recent inflation uptick, it’s essential to consider the broader economic context and recognize that inflation is influenced by multiple factors, particularly wages and labor costs. As wages rise, businesses may pass on higher costs to consumers, affecting prices. Comparing Statista’s January figures from the previous year, where the inflation rate stood at 6.4% and wage growth at 6.1%, to the most recent January 2024 report indicates a noteworthy shift.

Presently, the disparity has widened considerably, with wage growth hovering at 5% while the inflation rate registers at 3.1%. This indicates a more complex economic landscape where multiple factors beyond gasoline prices are at play in shaping inflationary pressures.

That being said, the impact of rising gas prices isn’t just felt at the pump; it affects many sectors of the economy. From transportation costs to manufacturing expenses and consumer spending habits, fluctuating energy prices have far-reaching effects. For instance, people spend more money on gas, so they have less for shopping. This means fewer customers in stores, but more online shopping. Also, shipping costs for stores go up.

In addition, more people use buses and trains because driving becomes expensive. People look for cars that use less fuel, like small cars or hybrids. Airplane tickets get more expensive because airlines have to pay more for fuel. Companies that use a lot of gas may hire fewer people when prices go up. And finally, when gas prices are low, businesses save money, so they may hire more people or start new projects. As a result, the widespread effect of increasing gas prices puts pressure on inflationary trends across the board.