Inflation tends to adversely affect stocks due to a contraction in consumer discretionary spending.

In times of rising inflation, many investors seek refuge in assets that can withstand economic pressures. While most stocks may falter under inflationary strains, there are select equities that remain resilient and continue to perform well. This article highlights five stocks that are not affected by inflation:

1. Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) operates in the healthcare sector. This sector normally remains stable even during tough economic times or periods of inflation because people consistently need healthcare products and services.

JNJ’s resilience to inflationary pressures is evident in its performance during Covid-19 pandemic, when inflation had risen to levels not seen in 40 years. While JNJ was trading at about $149 per share in May 2020, its price rose to $170 by May 2021 and $181 by 2022. This growth indicates that JNJ maintained its value and possibly outpaced inflation.

The ‘open secret’ to JNJ’s resilient performance against inflationary pressures lies in its strategically diversified product portfolio, spanning pharmaceuticals, medical devices, and consumer health sectors. Whether there is inflation or inflationary conjecture, JNJ has always achieved a 5% annual revenue growth rate since 2000, with gross margins consistently exceeding 65%.

2. Procter & Gamble (PG)

P&G, a consumer goods corporation, has defined five vectors for product superiority: product, packaging, communication, in-market execution, and value for both consumers and retailers. Basic household products like Tide detergent, user-friendly packaging for Gillette razors, and effective advertising campaigns for Pampers help safeguard P&G from the impact of heightened inflation.

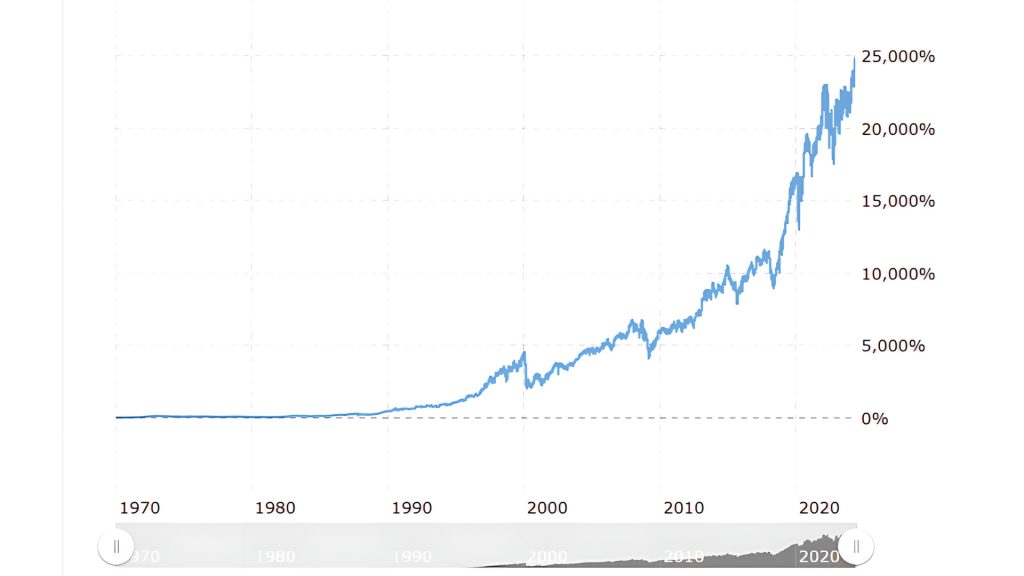

Over the past 30 years, P&G has shown remarkable stability and growth. Its average stock price rose from $6.97 in 1994 to $158.13 in 2024. This impressive increase, despite key inflationary periods such as the late 1990s, the 2008 financial crisis, and the post-2020 pandemic era, demonstrates P&G’s ability to maintain value and growth, proving itself as an inflation-resistant stock.

The company’s consistent value delivery, strong brand loyalty, and global presence have enabled it to maintain pricing power and protect profit margins. During the 2008 financial crisis, while many companies saw significant declines, P&G’s revenue only dipped by 3.2%, and it rapidly rebounded by 6.3% in 2009. Similarly, in the high-inflation period of 2021-2022, P&G increased its net sales by 5% and maintained a gross margin of 50.5%.

3. AstraZeneca PLC (AZN)

AstraZeneca’s diversified product portfolio, supported by oncology, cardiovascular, and respiratory drugs like Tagrisso, Brilinta, and Symbicort respectively, ensures revenue stability across various segments. The company invested $7.5 billion in R&D in 2023, focusing on developing innovative drugs to address unmet medical needs.

During the 2022 inflation spike, with U.S. inflation rates reaching 9.1%, AstraZeneca’s market capitalization grew by 20.44%, showing strong investor confidence.

Interestingly, despite legal challenges regarding its Oxford co-developed vaccine in April, the company exhibited sturdy growth in the past two months, with its stock surging from $68.20 on April 1 to $76.62 on May 30, representing a solid $8.42 increase or approximately 12.34%.

4. The Coca-Cola Company (KO)

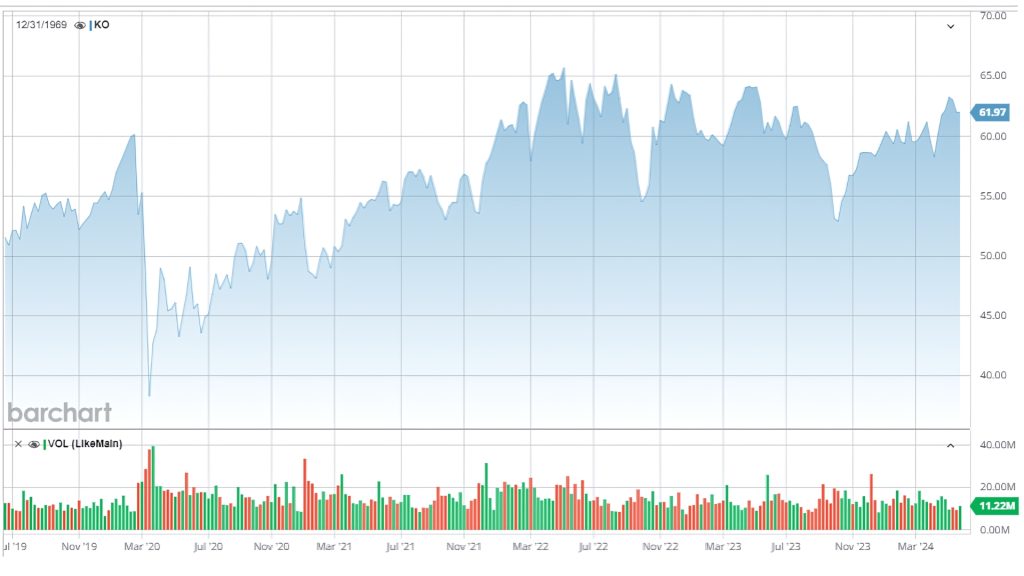

Coca-Cola’s varied beverages, including sodas, juices, teas, and water, buffer against changing tastes, securing steady revenues amid economic shifts. Its brand is recognized by about 94% of the world’s population, with a 2023 brand value of 106.1 billion U.S. dollars, an 8% increase compared to 2022.

In addition, KO’s efficient supply chain ensures global product availability, while strategic marketing investments sustain brand relevance, aiding resilience against inflation. Operating in over 200 countries, the company’s diverse portfolio includes over 3,900 beverages.

Coca-Cola’s century-long brand-building efforts yield widespread recognition and trust. And for them, this actually ensures stable demand and pricing power amidst inflationary pressures.

Even amid heightened inflationary pressures, Coca-Cola reported a net income of $10.714 billion in 2023, a 12.28% increase from 2022, and a $1.76 per share dividend. Coca-Cola Zero Sugar saw a 14% volume increase in 2022.

5. Church & Dwight Co., Inc (CHD)

Established in 1846, Church & Dwight dominates the U.S. sodium bicarbonate market, known for its baking soda products. The company owns trusted brands like Arm & Hammer, OxiClean, and Trojan, offering essential household and personal care products.

In addition, acquisitions of Waterpik and Flawless have diversified its portfolio and bolstered growth. Church & Dwight’s consistent dividend payments, with a median payout ratio of 32% over three years, reflect financial health and attract long-term investors, ensuring stability amid inflation.

Despite overall market slumps, Church & Dwight’s stock is at $104.36 with a strong 10.98% annual change in 2024, showcasing its inflation-resistant properties.