Economic indicators suggest a thriving post-pandemic recovery, yet a significant portion of Americans remain pessimistic about the nation’s financial health.

Less than a quarter of Americans (23%) consider the country’s economic conditions to be excellent or good, while 36% describe them as poor, and about four-in-ten (41%) view them as ‘only fair’. Interestingly, though, persistent misunderstandings about the fundamentals contribute to this dissonance, as reported in a CBS News poll earlier this year.

Recession Misconceptions

A recession is typically identified when there is a significant decline in economic activity across the economy, lasting more than a few months. While the common rule of thumb is two consecutive quarters (or six months) of negative GDP growth, economists often look at a range of indicators such as employment, industrial production, real income, and wholesale-retail sales to determine the start and end of a recession. The National Bureau of Economic Research (NBER) in the United States, which officially declares recessions, doesn’t rely solely on the two-quarter rule and instead considers the depth, diffusion, and duration of the downturn.

More than half of the surveyed Americans (56%) erroneously believe that the U.S. is currently ensnared in a recession, according to Harris Poll conducted by Guardian. However, the reality is quite different. Driven by strong consumer spending, GDP growth rates are exceeding economists’ expectations.

The gap between public perception and economic reality is shaped by several factors. These include reliance on policy-driven scenarios, anecdotal evidence, personal financial struggles overshadowing broader economic indicators, and media narratives that emphasize economic vulnerabilities.

Fed’s ‘Taming-Inflation’ Policy

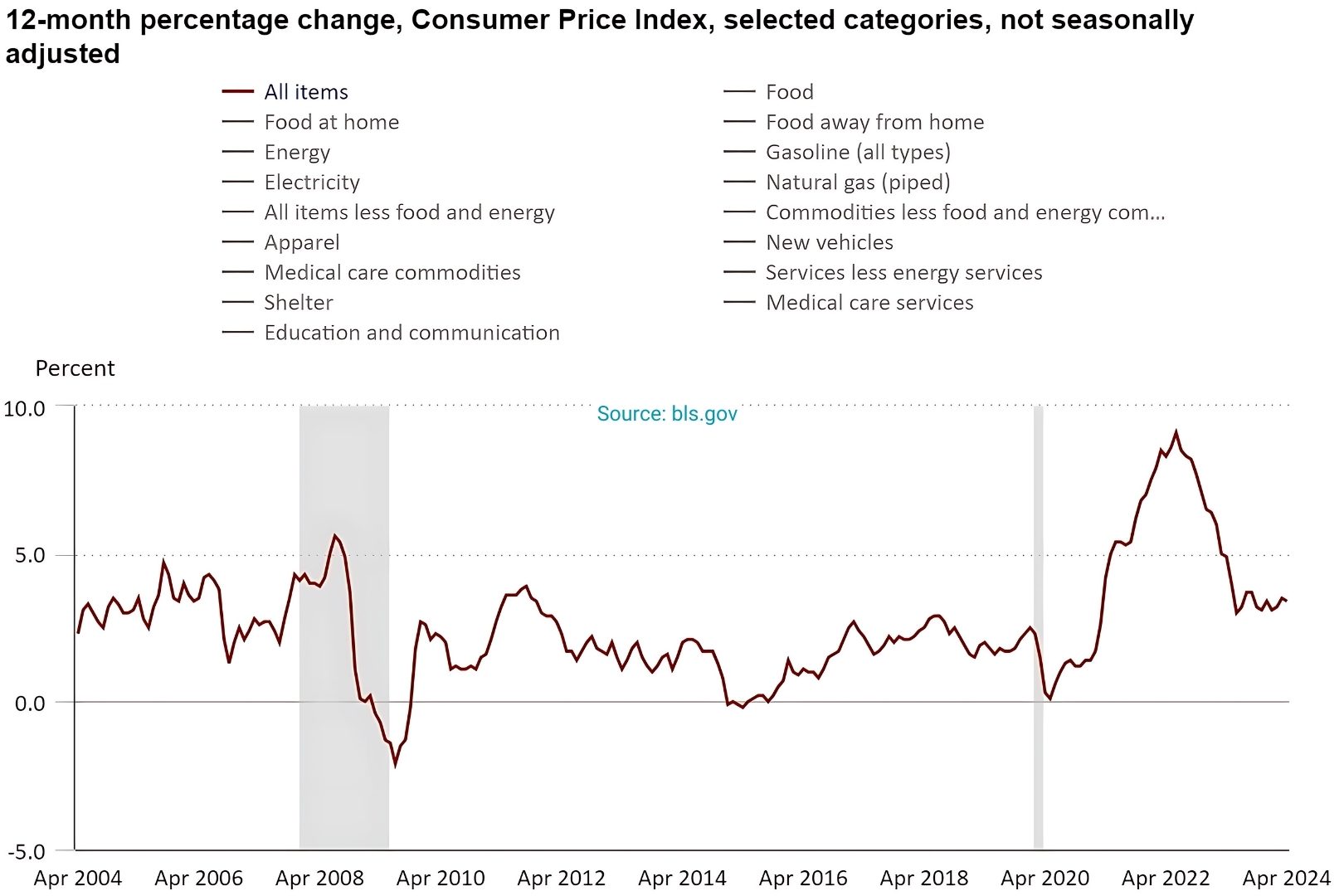

A widespread misunderstanding is about how the Federal Reserve impacts the economy, especially its link to recession. Some wrongly think that the Fed always slows down the economy, possibly pushing it into recession. This misconception comes from the idea that the Fed deliberately tightens access to credit in certain sectors to control inflation. Over two years, the central bank raised interest rates 17 times, reaching 5.33%, the highest in more than 20 years.

This increase coincided with a significant rise in the Consumer Price Index for All Urban Consumers (CPI-U), reaching a record high of 313.55 points, showing a 3.4 percent increase over the past year. However, the central bank’s main aim is undoubtedly to carefully manage constraints to tackle inflation without causing a recession, employing sophisticated monetary policies. When the Federal Reserve increases interest rates, it raises the cost of borrowing, affecting both credit and investment by making them more expensive.

Media Influence

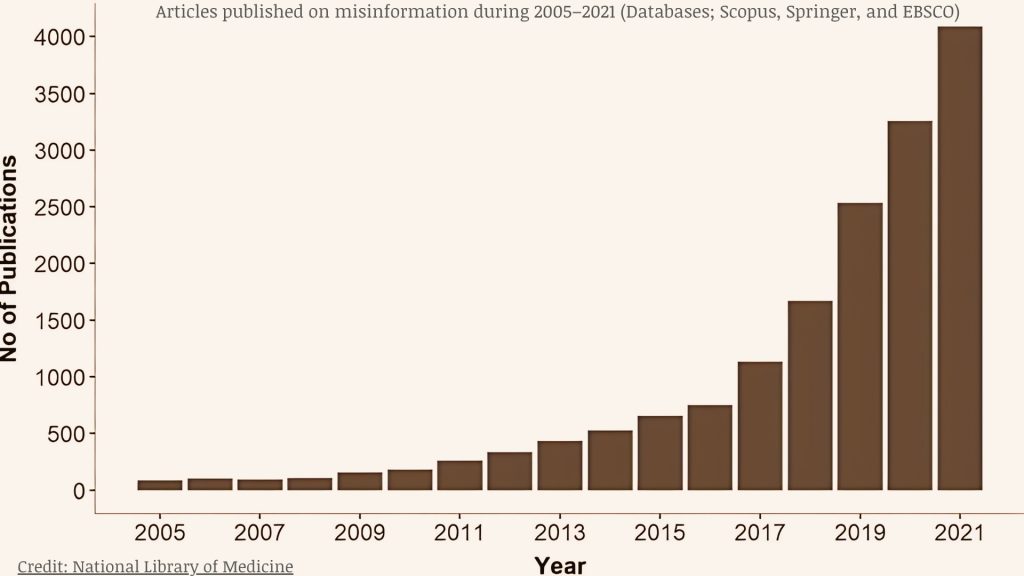

Studies show there is currently a widespread disaster of misinformation.

There is growing media coverage of economic events, significantly shaping public perception. However, this often leads to misunderstandings about recessions due to sensationalism and selective reporting. By prioritizing attention-grabbing headlines over detailed analysis, the media can amplify perceptions of recession severity, especially during uncertain times.

Alarmist language and a focus on negative indicators without context can distort assessments of economic health. This can fuel public anxiety. For example, reporting a modest decline in consumer spending without mentioning positive trends like job growth can create a false impression of an impending recession. This misrepresentation can influence public sentiment and consumer behavior, which is currently occurring.

Confirmation Bias

Confirmation bias is essentially a form of self-deception, with potentially massive consequences that vary when considered from either an individual or societal level. It can significantly contribute to misconceptions about recessions. This cognitive bias causes individuals to interpret new information in ways that affirm their existing beliefs, which can distort their understanding of economic conditions.

If someone firmly believes a recession is imminent, they may interpret ambiguous or mixed economic data as confirmation of their belief. They might focus on a rise in government borrowing as a sure sign of impending economic trouble, while disregarding other positive indicators like low unemployment rates or strong consumer spending.

This kind of selective interpretation reinforces one’s belief in an impending recession, even if the overall economic data suggests stability or growth.

In addition, this bias can also influence public opinion and policy decisions. When confirmation bias is widespread, it can lead to a collective misreading of economic conditions, potentially resulting in premature or inappropriate economic measures.

Stock Market Performance

The performance of the stock market, particularly the S&P 500 index, is another area rife with public misunderstanding. The S&P 500 has ascended by approximately 11% in 2024, indicating good market health. Nevertheless, about half of the respondents in the Harris/The Guardian poll incorrectly opine that the stock market has depreciated over the year.

This misalignment between public perception and market reality can be attributed to cognitive biases, which are systematic patterns of deviation from rationality in judgment, leading individuals to interpret and process information in a subjective manner.

As of now, around 60% of Americans own stocks. Investors often miss opportunities and make impulsive decisions during market downturns due to the recency effect, wherein they prioritize short-term fluctuations over long-term trends and historical evidence of market resilience.

This cognitive bias leads individuals to focus excessively on immediate negative impacts, potentially clouding their judgment.

A Misguided View of Unemployment Rates

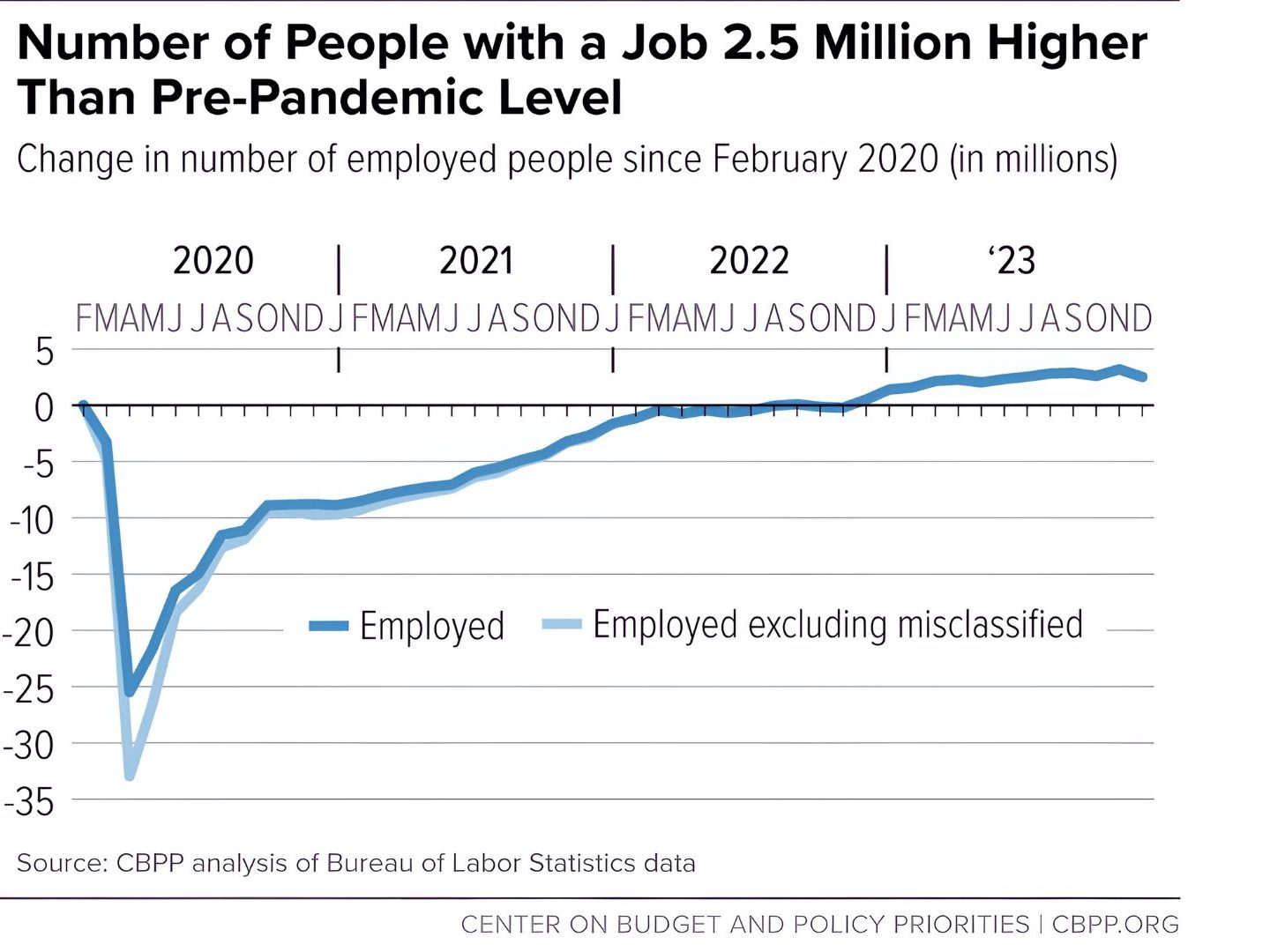

Unemployment rates, a critical barometer of labor market health, are currently near a 50-year low, with the jobless rate standing at 3.9% in April. The rate has remained in a narrow range of 3.7 percent to 3.9 percent since August 2023.

This figure aligns closely with pre-pandemic levels, indicating a substantial recovery in the labor market. Yet, paradoxically, about half of the survey participants believe that unemployment is near a 50-year high.

This notable disparity may come from a misunderstanding between absolute unemployment figures and the broader context of employment conditions. The lingering impacts of the pandemic, such as sector-specific job losses and the emergence of gig economy roles, might contribute to a perception of heightened job insecurity despite the overall low unemployment rate.

Furthermore, the media’s emphasis on high-profile layoffs and corporate downsizing intensifies concerns about widespread unemployment, reinforcing this misconception.

Inflation: Rising or Falling?

Inflation, defined as the rate of change in prices, has been on a declining trajectory since peaking at 9.1% in June 2022. As of the latest Consumer Price Index (CPI) reading, inflation stands at 3.4% in April, reflecting a significant moderation.

However, approximately 70% of the respondents in the Harris/The Guardian poll contend that inflation is rising.

This misinterpretation might originate from misunderstanding the difference between inflation rates and the cost of living. While the rate of inflation has decelerated, leading to slower price increases, the absolute price levels continue to rise, albeit at a diminished pace.

Many people don’t grasp this detail, so they mistakenly think inflation keeps going up. Also, past high inflation still affects household budgets, making it seem like inflation is still a big problem.

To Sum Up

The gap between what people believe about the economy and what economic data actually shows highlights how traditional measurements can miss the complex financial realities people experience.

Common indicators like GDP growth, stock market numbers, and unemployment rates provide useful information, but they don’t always reflect the economic challenges faced by different groups of people. Things like income inequality, differences in regional economies, and downturns in specific industries often get overlooked in these big-picture statistics. This can leave many feeling dissatisfied with the economy.

As discussed earlier, people’s perceptions of the economy can also be influenced by mental shortcuts and the tendency to believe information that confirms their views. For example, personal financial struggles and negative news might feel more significant than broader economic trends, shaping how individuals see the economy around them.

On top of everything, media narratives, often sensationalized, exacerbate these biases. This reinforces public misconceptions about economic health. Responsible journalism, prioritizing data-driven reporting and contextual analysis, has the potential to align public sentiment with economic reality by demystifying complex economic phenomena and providing balanced perspectives.